by Tyler Arnold

As President Joe Biden’s student debt relief plan remains tied up in the courts, many Virginia student loan holders are still unsure whether they will have some of their debt forgiven.

About 12.5 percent of Virginians, which is more than 1.08 million people, owe some money on student loans. The average amount of debt per borrower is the fourth highest in the country at more than $39,000 per person, according to the Education Data Initiative. More than 85 percent of borrowers currently owe more than $5,000 in loans and the total amount of money owed on student loans in the commonwealth is about $42.4 billion.

President Joe Biden’s student debt relief plan would provide up to $20,000 in relief to Pell grant recipients and up to $10,000 in relief for non-Pell Grant recipients. A large majority of borrowers would be eligible for the relief, because a person would be allowed to apply as long as they earn less than $125,000 per year.

The relief plan faced multiple legal challenges and remains tied up in the court system. On Thursday, the administration faced another setback when the 5th U.S. Circuit Court of Appeals declined to halt an order from a Texas judge that blocked the payments. The U.S. Supreme Court said it will take up the issue.

Christian Barnard, a senior policy analyst at the libertarian Reason Foundation, told The Center Square that he does not believe Biden had the authority to bypass Congress and thinks the debt relief plan would ultimately be bad for Virginians.

“I don’t think the president has the constitutional authority to waive $400 billion in student loan debt without congressional approval,” Barnard said. “The administration’s legal reasoning is based on the 2003 Higher Education Relief Opportunities for Students Act, which does grant the education department limited authority to provide student loan relief. But the administration’s argument significantly stretches the language of that law and assumes most student loan debt holders are in a worse financial situation due to the pandemic, a claim that severely lacks evidence.”

Although Biden’s plan would temporarily provide relief, Barnard said it does not solve any of the problems that caused the student debt crisis in the first place.

“This short-term relief is a net negative for state residents because it doesn’t address the underlying problem of rising tuition costs at Virginia colleges and universities,” Barnard said. “The average cost of college attendance for in-state undergraduates who are full-time rose by 33 percent between 2011-2012 and 2020-2021 according to the State Council for Higher Education in Virginia. The one-time relief would do nothing to slow the growth in tuition costs and wouldn’t benefit the 87.5 percent of state residents who hold no student loan debt.”

Several legal challenges are still ongoing.

– – –

Tyler Arnold reports on Virginia and West Virginia for The Center Square. He previously worked for the Cause of Action Institute and has been published in Business Insider, USA TODAY College, National Review Online and the Washington Free Beacon.

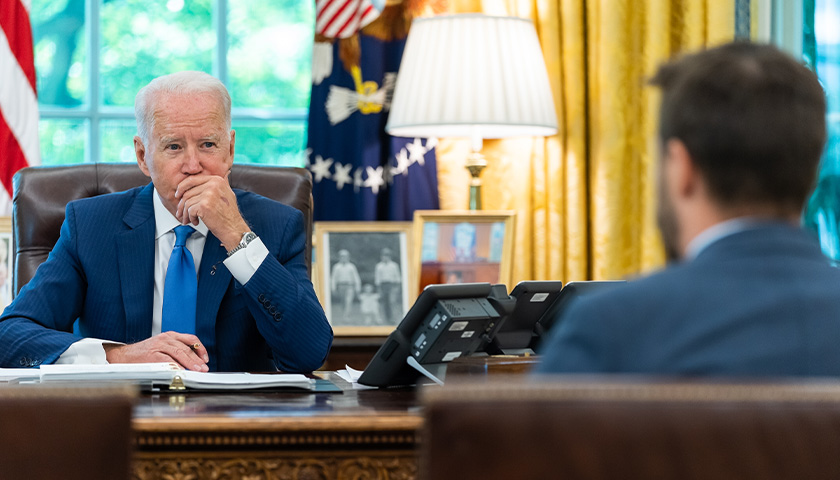

Photo “Joe Biden DIscussing Student Debt” by The White House.