By Robert Romano

114 out of the nation’s 1,400 multi-employer pension plans covering 1.3 million workers are underfunded to the tune of $36.4 billion, with plans expected to start going insolvent in the next 5 years or so, an Aug. 2017 analysis by Cheiron has found.

This is the end result of unsustainable collective bargaining arrangements between unions and employer, creating defined benefit pension plans that promise retirements far in excess of what could be justified by monthly contributions and market returns. If these had been investment products, surely the Securities and Exchange Commission might have investigated for fraud. But because they were collectively bargained pensions, a different set of fiduciary rules apply.

Other factors leading to the shortfall include unfavorable demographics with fewer new workers joining the plan as the ratio of workers to retirees continues to drop.

Unfortunately for pensioners, that will mean a huge cut in retirement benefits should the plans go belly up. Even with federally backed Pension Benefit Guaranty Corporation (PBGC), in the event of failure, only a fraction of benefits will be paid out.

According to the PBGC, the payouts under existing law can be “summarized as a maximum guarantee amount of $12,870 per year (payments are made monthly). But that is only a special case of the guarantee; it applies to people who worked exactly 30 years in jobs covered by the plan and have a moderately high promised benefit. PBGC’s maximum guarantee is lower for participants who worked fewer than 30 years and higher for those who worked more than 30 years.”

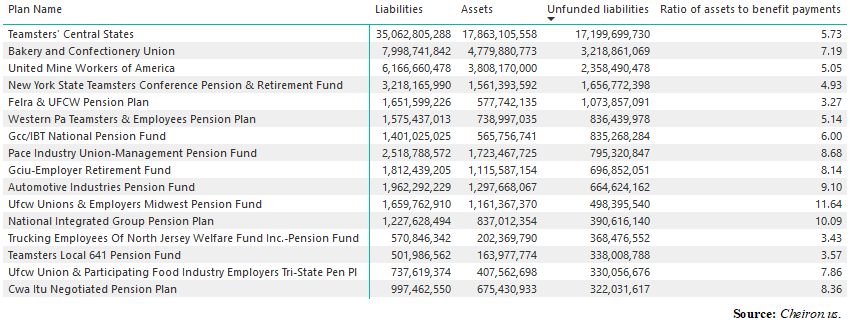

Of the $36.4 billion in unfunded liabilities, 47 percent or $17.2 billion is for a single plan, the Teamsters Central States fund.

Other affected plans include Baker and Confectionery Union at $3.2 billion of unfunded liabilities, United Mine Workers of America at $2.3 billion, New York State Teamsters Conference Pension & Retirement Fund at $1.65 billion, Felra & UFCW Pension Plan at almost $1.1 billion, Western Pa Teamsters & Employees Pension Plan at $836 million and Gcc/IBT National Pension Fund at $835 million. The remaining $10 billion of unfunded liabilities is distributed among the smaller plans.

Making matters worse, the PBGC does not appear to be up to the task of covering the failing plans. According to the agency’s annual report released in Nov. 2017: “As of September 30, 2017, PBGC reported in its financial statements net deficit positions (liabilities in excess of assets) in the Single-Employer and Multiemployer Program Funds of approximately $11 billion and $65 billion, respectively.” In 2016, it projecteda 90 percent chance the agency would run out of money by 2035, and 50 percent chance by 2025.

Right now, the plans have to figure out how to cut benefits in order to be survivable.

In the meantime, Congress is stepping into the crisis, with the Joint Select Committee on Solvency of Multiemployer Plans expected to be completing its work on a report to make recommendations for the PBGC and Congress to follow. One idea being discussed is a loan program to shore up the system.

Americans for Limited Government President Rick Manning commented on the idea in a July 12 statement saying that unions had to have skin in the game for anything Congress is considering, “If there is going to be a low interest rate loan program to undergird the massive soon-to-be insolvent multiemployer pension plans, then the unions must have skin in the game and be in 50/50 with corporations on any risk pool that might be created in the event of defaults. There should also be full transparency including annual external audits for all affected multiemployer pension plans and there must be a way for companies to exit and decertify the union by replacing the lump sum payment with payments over a longer period of time. Finally, there must be a commitment to unwind and eliminate over time the unsustainable defined benefit formula that caused the insolvency in the first place and became a false promise to pensioners.”

Manning added, concluding, “In the event such a loan program and risk pool fails to shore up the system, the losses must be borne by the pensions via benefit cuts — not by taxpayers. This is a predictable crisis that can be averted.” Perhaps so. But to get there, it is going to take a real commitment to reform and to ensuring that this can never happen again. It’s time to retire the defined benefit plan, as corporate America has already done, once and for all.

– – –

Robert Romano is the Vice President of Public Policy at Americans for Limited