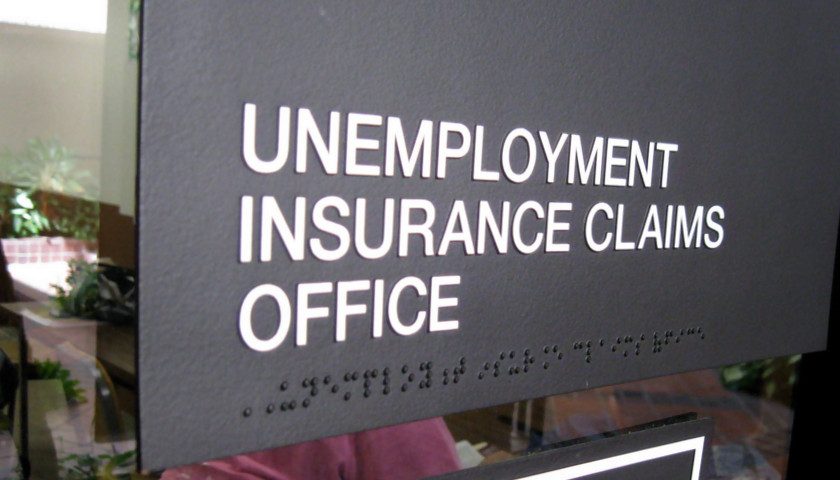

The federal officials tasked with tracking down widespread fraud during and after the COVID-19 pandemic want more time and more money to finish the job.

The Justice Department’s COVID-19 Fraud Enforcement Task Force, made up of nearly 30 federal agencies, released its 2024 report on Tuesday. The report details the efforts of the task force in response to fraud involving COVID-19 relief programs.

Read More