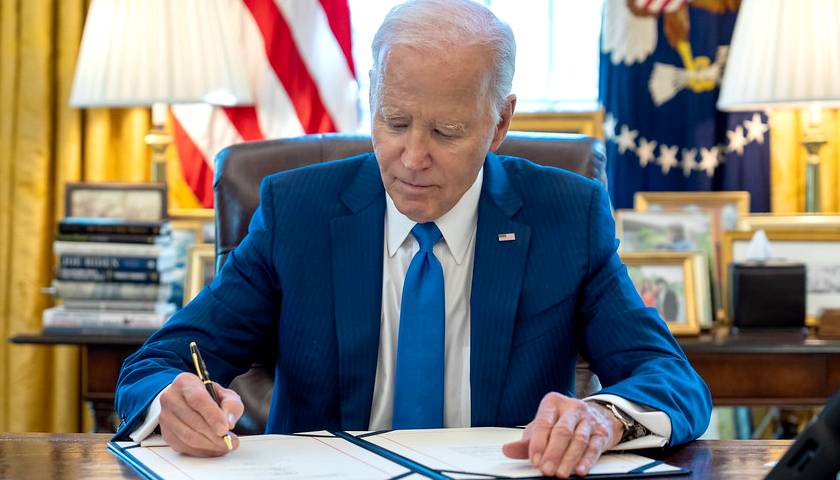

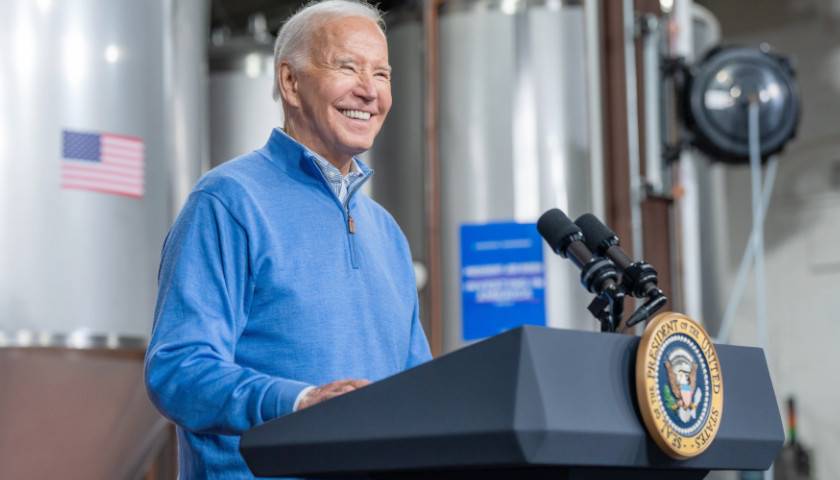

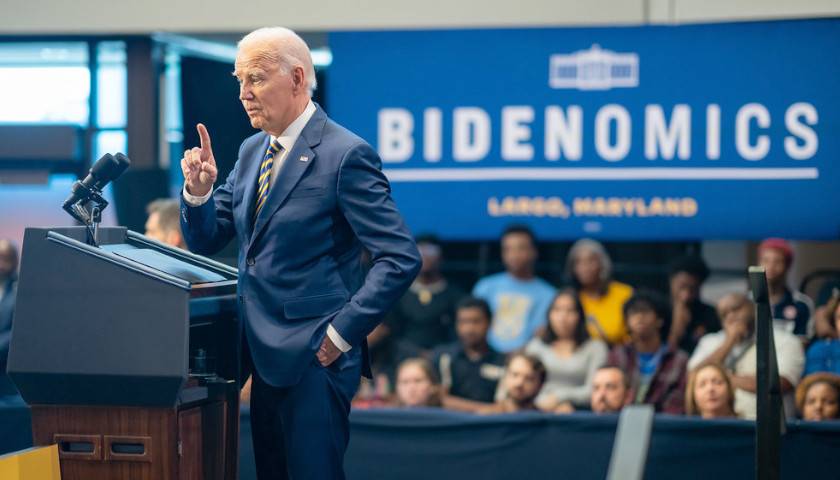

The latest Harvard Youth Poll reveals President Joe Biden has lost significant ground with voters under thirty compared to four years ago, with a 20-point decline among young men. While young Americans give Biden low marks on foreign policy and economic issues including inflation, housing, and the job market, immigration is a leading factor in young people’s departure from Democrats.

Biden currently leads Trump by thirteen percentage points (50 percent to 37 percent) among registered voters under thirty in the Harvard Youth Poll, a slightly higher margin than he has led by in other recent polls that include young people as a subset.

Read More