by Robert Hughes

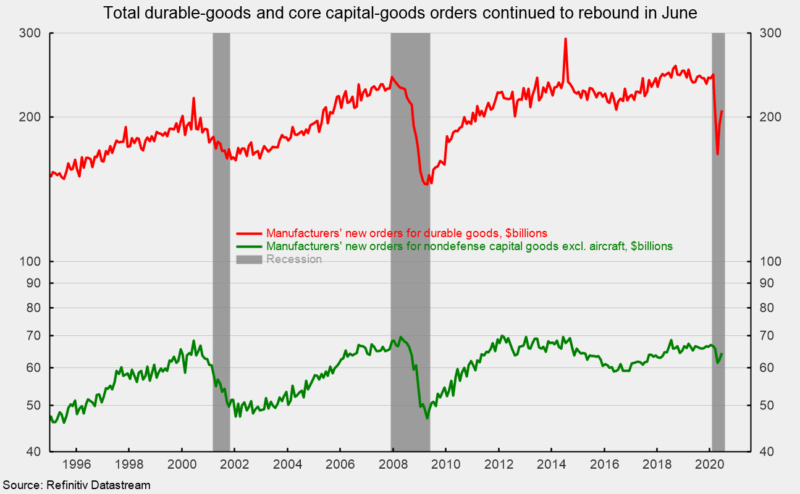

New orders for durable goods posted a second consecutive month of rebound in June, rising 7.3 percent following a gain of 15.1 percent in May. The two gains followed drops of 18.3 percent in April and 16.7 percent in March. If transportation equipment is excluded, new orders for durable goods increased 3.3 percent in June following a 3.6 percent rise in May. Durable-goods orders had been holding above the $200 billion level since May 2011 before posting sharp declines in March and April (see first chart). New orders for June are back above the $200 billion threshold, totaling $206.9 billion, but are still 21.9 percent below June 2019.

New orders for nondefense capital goods excluding aircraft, a proxy for business equipment investment, rose 3.4 percent in June after gaining 1.6 percent in May. This category had drops of 6.4 percent in April and 1.3 percent in March. This key category had been range bound since 2011, hovering in the $60 to $70 billion range. The $61.3 billion pace for April was the slowest since August 2017 but the May and June gains put the level back up to $64.3 billion (see first chart). If the April low holds, that will be well above the lows of the prior two recessions.

New orders for nondefense capital goods excluding aircraft, a proxy for business equipment investment, rose 3.4 percent in June after gaining 1.6 percent in May. This category had drops of 6.4 percent in April and 1.3 percent in March. This key category had been range bound since 2011, hovering in the $60 to $70 billion range. The $61.3 billion pace for April was the slowest since August 2017 but the May and June gains put the level back up to $64.3 billion (see first chart). If the April low holds, that will be well above the lows of the prior two recessions.

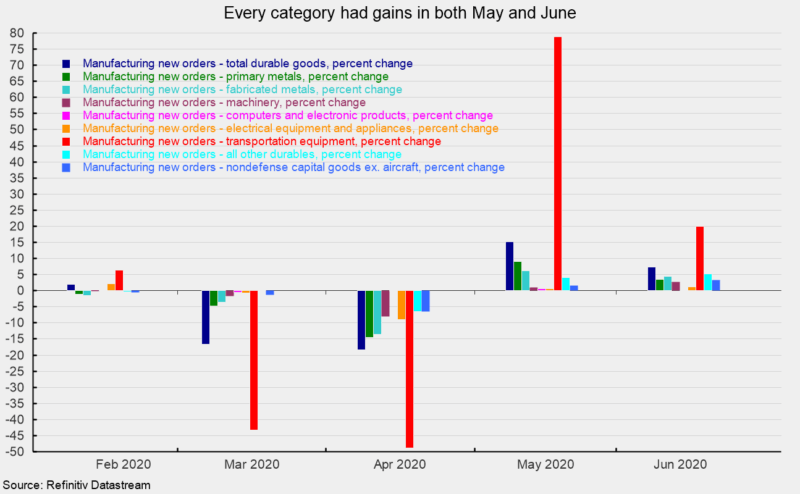

The major categories of durable goods shown in the report all posted gains in the latest month. Among the individual categories, primary metals rose 3.6 percent, fabricated metal products gained 4.5 percent, machinery orders were up 2.7 percent, computers and electronic products increased 0.1 percent, electrical equipment and appliances added 1.2 percent, transportation equipment orders surged 20.0 percent, and the catch-all “other durables” category was up 5.2 percent (see second chart).

Within the transportation category, motor vehicles were up 85.7 percent following a gain of 28.8 percent in May while defense aircraft orders decreased 30.6 percent in June. Nondefense aircraft orders totaled -$10.4 billion, the third month of net negative orders in the past four months. Net negative new orders represent cancellation of previously placed orders totaling more than total new orders for the period. Significant cancellations over the past few months have left unfilled orders for nondefense aircraft at $503.1 billion, the lowest total since September 2013.

Within the transportation category, motor vehicles were up 85.7 percent following a gain of 28.8 percent in May while defense aircraft orders decreased 30.6 percent in June. Nondefense aircraft orders totaled -$10.4 billion, the third month of net negative orders in the past four months. Net negative new orders represent cancellation of previously placed orders totaling more than total new orders for the period. Significant cancellations over the past few months have left unfilled orders for nondefense aircraft at $503.1 billion, the lowest total since September 2013.

The report on durable-goods orders reflects the reversal of government shutdown policies implemented in reaction to the outbreak of COVID-19. Extraordinary damage has been caused, but as government restrictions are eased, signs of healing are beginning to emerge. The major risk is the resurgence of COVID-19 cases and deaths, which could lead to renewed waves of layoffs, consumer retrenchment, or government lockdowns.

– – –

Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Bob was formerly the head of Global Equity Strategy for Brown Brothers Harriman, where he developed equity investment strategy combining top-down macro analysis with bottom-up fundamentals.