by Casey Harper

U.S. House Speaker Nancy Pelosi, D-Calif., doubled down on the inclusion in a spending bill of a Democratic provision that would require banks to report to the IRS transactions for accounts holding over $600.

When asked Tuesday if the IRS monitoring would remain in Democrats’ proposed $3.5 trillion reconciliation legislation, Pelosi emphatically said “yes.”

“Yes. There are concerns that some people have, but if people are breaking the law and not paying their taxes, one way to track them is through the banking measure,” she told reporters. “I think 600…that’s a negotiation that will go on as to what the amount is, but yes.”

The “concerns” Pelosi referenced are coming from a wider array of critics as banks, other businesses, lawmakers and trade associations are rising in opposition to the plan.

“The effects of this scheme are serious and far-reaching, putting the IRS between millions of people and their banks,” said Billy Rielly, spokesman for the Consumer Bankers Association.

Under Biden’s Build Back Better plan, the IRS would receive a major increase in funding to beef up their auditing efforts. Democrats argue the increased revenue from audits would more than pay for the investment and help fund provisions in the $3.5 trillion bill.

This issue sparked national controversy, though, when news broke that as part of beefing up the IRS audits, banks would be required under the Democratic proposal to report to the IRS bank transactions over $600 as well as transactions for accounts containing over $600.

“I’m not surprised by [Pelosi’s comments], that they would continue to press forward… we will continue to oppose,” said Aaron Stetter, executive vice president of Policy and Political Operations at the Independent Community Bankers of America. “The proposal still needs to be borne out, so the devil is in the details but … it is going to be impractical. It is going to make it much more difficult for the banks to administer, and all of that burden falls disproportionately on the smallest banks that don’t have the [same] ability to keep all of that compliance.”

Stetter said the IRS monitoring is a “quasi-violation of due process,” an argument some lawmakers have made as well. He added that small businesses, realtors, and other regular Americans will be flagged and audited at higher levels under the plan and that the banks he represents have heard from many concerned customers because of this provision.

“You are being deemed a tax cheat until proven otherwise,” he said.

Democrats have argued that the plan will help catch wealthy tax evaders, but opponents say it will put a major burden on banks and will be a sweeping data collection by the federal government affecting the vast majority of Americans, not just the wealthy.

Democrats have indicated their intent to push through with the proposal, though they have said the $600 figure could increase to a higher benchmark.

Meanwhile, opposition to the proposal has continued to grow.

Tennessee Treasurer David Lillard called Biden’s plan an “invasion of privacy” this week, joining about two dozen state treasurers who have reached out to the Biden administration to raise concerns about the plan.

“While the Biden Administration is trying to bill this as ‘improving tax compliance’ on the wealthy, this plan is a massive invasion of the privacy of middle-income Americans and an unnecessary, tremendous compliance burden on community bankers,” Lillard said. “It will substantially increase the unbanked in our nation.”

More than 40 trade associations sent a letter last month to the Biden administration asking them to nix the IRS monitoring scheme, citing privacy and security concerns as well as the financial toll on banks to comply with the complex regulation.

The letter was signed by industry groups across the spectrum as well as banking groups, including the Consumer Bankers Association, American Bankers Association, and others.

“While the stated goal of this vast data collection is to uncover tax dodging by the wealthy, this proposal is not remotely targeted to that purpose or that population,” the letter said. “In addition to the significant privacy concerns, it would create tremendous liability for all affected parties by requiring the collection of financial information for nearly every American without proper explanation of how the IRS will store, protect, and use this enormous trove of personal financial information. We believe that this program is costly for all parties, not fit for purpose, and loaded with potential for unintended and serious negative consequences.”

Republican lawmakers have challenged the Democrats’ plan as well.

“Democrats’ proposal would enable the IRS to monitor what goes in and out of Americans’ bank accounts,” said U.S. Sen. Roy Blunt, R-Missouri. “This would be an unprecedented invasion of privacy.”

They responded quickly to Pelosi’s comments Tuesday, making the controversial pay-for front and center as Democrats enter tense negotiations over the size of the bill, and how to pay for it.

“Nancy Pelosi confirms that the Biden plan will give the IRS your private banking data if you have *just $600* in your account,” U.S. Sen. Tom Cotton, R-Ark, wrote on Twitter. “When they say they’ll only tax the rich, they’re lying.”

– – –

Casey Harper is a Senior Reporter for The Center Square and the Washington, D.C. Bureau. He previously worked for The Daily Caller, The Hill, and Sinclair Broadcast Group. A graduate of Hillsdale College, Casey’s work has also appeared in Fox News, Fox Business, and USA Today.

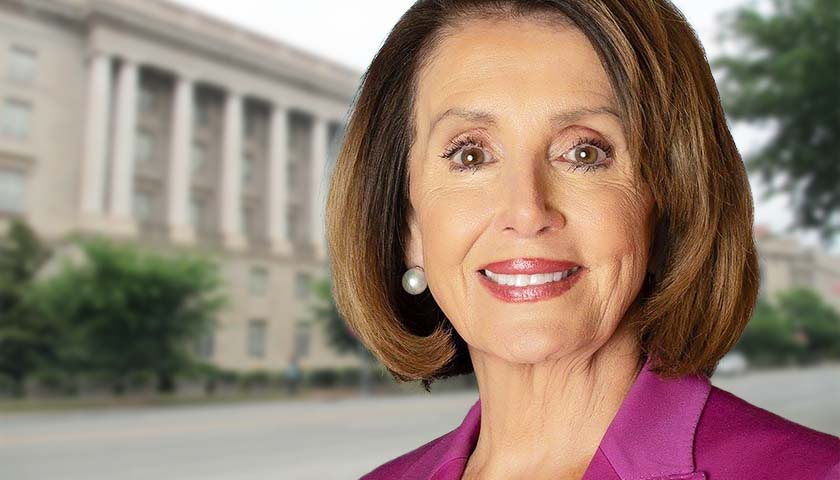

Photo “Nancy Pelosi” by House Speaker Nancy Pelosi. Background Photo “Internal Revenue Service” by Joshua Doubek. CC BY-SA 3.0.