by John F. Wasik

When Sam Semilia toted up his retirement finances, he was pretty sure that he was due a pension from his time working as a steam engineer for the Diamond Crystal salt company four decades before. Salty is one way to describe the search for his money, a four-year odyssey filled with shredded paper trails and assorted dead ends, along with a brief history of modern American capitalism.

These obstacles included the fact that while Diamond Crystal was still a familiar brand, it had been bought and sold by several companies through the years – each one newly responsible for old pensioners. As he traced that snaking path, he found that his original paperwork may have no longer existed, as business records mostly went digital since he left the company in 1979. “I don’t know how someone would do it without documents,” said Semilia, 71. “I kept all of them, including a worksheet and cover letter, but it still wasn’t good enough.”

Over the past several decades, as a wave of stock-market crashes, recessions, de-industrialization, and the pandemic have roiled U.S.-based companies, millions of workers like Semilia have been impacted by “lost” or terminated pensions. Many may not know how to claim the money they earned.

While business owners are required to inform participants when a defined benefit plan shuts down or “terminates,” the process is often far from smooth – especially when workers have moved. As a result, it is often supremely challenging to know where to look or whom to ask, even when pensioners have all their records.

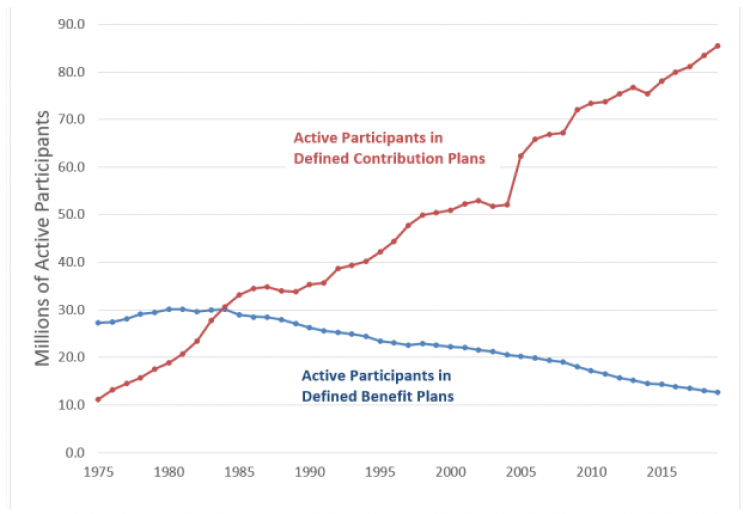

At stake are hundreds of millions of dollars from defined benefit (DB) pension plans – the “old-style,” single-employer plans that used to guarantee lifetime benefits. More than 61,000 defined benefit plans have been terminated by employers over the past 30 years. These pensions used to guarantee payments at retirement, but now they are rarely offered to new corporate employees, although they are more often used in the public sector.

But all is not lost. Many of these plans are backstopped by the Pension Benefit Guaranty Corporation. Created by federal law in 1974, the PBGC is similar to the Federal Deposit Insurance Corporation. A quasi-public insurance/regulatory entity, it monitors and insures trustee defined benefit pension plans. When companies fail, or they terminate their plans, these are taken over by the PBGC. It collects premiums from companies to cover beneficiary payments and administrative costs. All told, the PBGC is responsible for current and future pensions for workers in 4,200 single-employer and multiemployer pension plans.

Yet trying to find out if you’re entitled to unclaimed defined benefit pension payments is like entering a bewildering labyrinth. If you know the exact name of your plan or the current name of the company administering it (or if the PBGC is the trustee of a terminated plan), that’s a start.

One Man’s Search

As Semilia began searching for his pension in 2016, he was well prepared. He had documents verifying his benefits, a company cover letter, and even a statement of earnings from the Internal Revenue Service. He had called every agency from the U.S. Department of Labor to the many corporations that had acquired Diamond Crystal over the past four decades.

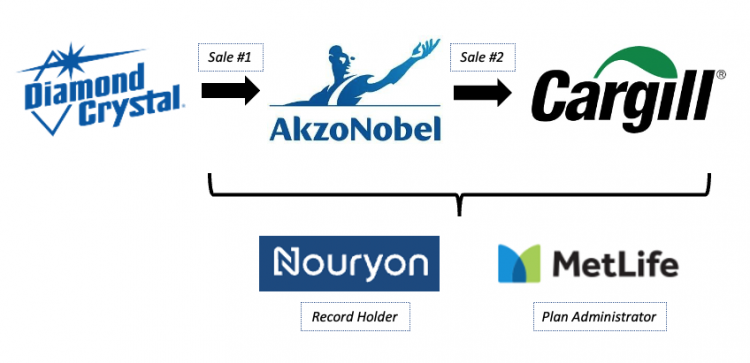

He learned that Diamond had changed hands multiple times. As near as Semilia could figure, its convoluted string of owners included the multinational corporation AkzoNobel, and another major corporation, Cargill. Further complicating matters: As Semilia would come to discover, one of AkzoNobel’s spinoffs – Nouryon Chemicals – was a custodian of relevant records. Complicating matters still further, MetLife had been retained at some point to administer the benefits.

He hit a major roadblock when an AkzoNobel representative told him they had found his file but that it showed he had accepted a lump sum payment in 1990. This was not correct.

Despite calling these various organizations every 90 days or so, he never received a payment. Neither the Social Security Administration nor the IRS could not warm his cold trail.

In utter frustration, Semilia sought help. He connected with Jennifer Anders-Gable, a lawyer with Western States Pension Assistance Project, a nonprofit that helps people track down pensions. With her assistance, Nouryon located Semilia’s records. It paid him over $5,200 in retroactive benefits (including interest) and continued to pay him the monthly $81 benefit he earned many decades ago. “He was surprised that things worked out so quickly after we got involved since he had been trying to initiate benefits for years on his own,” Anders-Gable said.

Semilia’s experience is not unusual, said Jane Smith, a policy analyst with the nonprofit Pension Rights Center, “Unless you get lucky in an internet search,” she said, “a pension plan can be extremely hard to locate.” The center’s chief operating officer, Kyle Garrett, added, “A lot of people are not internet savvy and they will hit a lot of dead ends.”

Dumping Pensions

Defined benefit plans used to be the gold standard in private-sector retirement plans. Back in 1975, they covered more than 27 million workers; today it is fewer than half that number, according to the Congressional Research Service. Now 401(k)-style plans predominate in the retirement programs of private employers, covering more than 85 million employees.

Companies have been accused of “dumping” pensions into the lap of the PBGC, which has financially struggled in recent years to keep up with terminations. When companies experience financial difficulties or choose to direct corporate capital elsewhere, they often underfund their plans. Under the most dire circumstances, they can terminate them, leaving the PBGC on the hook for billions in future benefits – and shortchanging workers who were expecting those payments.

If a plan terminates, the PBGC may not make a former employee whole on the entire benefit that was promised at retirement. It will pay an annuity based on the retiree’s age and employment duration. The maximum annual benefit the PBGC will pay depends on the person’s age: The younger he or she is, the lower the monthly benefit.

United Airlines, for example, shut down its pension plan as part of bankruptcy reorganization for 14,000 active and retired pilots in 2004. At the time, the severely underfunded plan had $2.8 billion to cover $5.7 billion in owed benefits, known as “liabilities.” The PBGC only covered $1.4 billion in future worker payments. It was the third-largest claim in the history of the PBGC at the time. Pilots saw their future pension payments reduced by thousands of dollars a year.

The PBGC insures only defined benefit pension plans, which began to disappear in the 1970s. These are not to be confused with the 401(k)-style defined contribution (DC) plans now common in the private sector’s retirement programs.

Employers and professional fund trustees held and managed the assets of DB plans; employees never really owned or had direct access to them. By contrast, employees own and manage the money in their 401(k) plans and take it with them when they change jobs (although that doesn’t always happen). Unlike defined benefit plans, however, 401(k)s do not make guaranteed payments and are not insured by the PBGC.

The Spreadsheet From Hell

Pension plan administrators and the PBGC are obligated to track down beneficiaries who have moved on, but the companies that originally provided the plans may have gone into bankruptcy, merged, been acquired, or moved. They are difficult to trace. Yet another wrinkle is that your employer may have terminated a plan after you left the company.

The PBGC has a long spreadsheet list of terminated or “trusteed” plans that is available online, but it’s more than 5,000 lines long . . . and unalphabetized. It’s not user-friendly unless you know what you’re looking for and know the precise name of the company plan.

You also need to know if you qualified for a benefit and how much that benefit would be, given your years of service. DB plans have various, often complex “vesting” periods that would qualify you for payments. To know if you’re due a pension, you would need to know those rules at the time you signed up or have a summary document of those rules.

The spreadsheet list, however, is only for single-employer plans that have shut down. It doesn’t include multi-employer plans, the names of potential beneficiaries, or the vesting rules for those plans.

“Not everyone who worked for a company is eligible to participate in a plan and earn a vested benefit,” the PBGC states. “Typically, individuals must work at least five years and meet other requirements to earn a benefit.”

Ideally, one federal agency should have an easily searchable online portal to find lost benefits, but at present the information is dispersed in multiple places. The resources needed to help pensioners are sparse and scattered. It’s easier to search for a restaurant near you or to order consumer goods online.

Government Overwhelmed

Considering the amount of money involved, and what an important source of income this is for retired Americans, it would be reasonable to expect that between the PBGC, the Department of Labor, and the IRS, the effort to locate pension recipients would be more robust. But that’s not the case.

The IRS, for example, used to notify beneficiaries that they were entitled to benefits. That service was discontinued in 2012, when the agency announced that it would “no longer process requests to locate retirement plan participants or beneficiaries.” Retirees were advised by the IRS to use an online search, a commercial locator, or “credit reporting agencies” to retrieve their pension benefits.

A likely candidate to help beneficiaries would be the U.S. Department of Labor. While the DOL has a mountain of reporting requirements and vast enforcement capability, it doesn’t offer a service to find lost pensions. (If a pension that you know you have is underfunded, the DOL can provide that information.)

A PBGC Advocate office was set up to assist beneficiaries. This under-publicized unit has a staff of three people, and is led by Constance Donovan, who said her office only receives about 20 inquiries a year regarding lost pensions. She didn’t know the current number of beneficiaries entitled to benefits, although her staff works with the PBGC’s “Missing Participant Program,” a liaison with employers that was expanded in 2018 to locate beneficiaries of defined contribution plans (401[k]-type programs).

“In some instances, we find out that someone is entitled to a benefit, but the name of the plan may have changed or the assets have been sold to another company,” Donovan said. She added: “There is no system to track pensions. It’s a developing problem.”

There are nonprofit resources that can help. The aforementioned Pension Rights Center provides free legal assistance and counseling. You can also enlist a commercial unclaimed assets search service. In addition, the PBGC provides some tips on looking for an unclaimed pension.

Congress to the Rescue?

A searchable, user-friendly pension registry listing all shuttered DB plans, companies, and ways to connect with lost benefits would make eminent sense, but it doesn’t exist. Considering that the PBGC has been around since 1974, this essential service is painfully slow in coming. The PBGC Advocate’s office and the Pension Rights Center have been working on such a registry for years.

Of course, after some due diligence, you may be able to track down benefits from searching the PBGC’s “unclaimed pensions” page—if you have the name of the plan and other details—but there are a few hitches: The agency has to have insured the plan and taken it over. Not all DB plans are covered by the agency. And the agency lacks a tool that links a renamed insured plan to a former plan.

The U.S. House of Representatives on May 4, 2021 passed the Securing a Strong Retirement Act, which would create a registry of retirement plans to be housed at the Department of Labor “that would enable persons to find a current contact for their plans so that they may claim their benefits.” The registry would also provide information on defined contribution plans. The Pension Rights Center, which supports the legislation, notes that “the registry is not final yet and could be changed, or even eliminated, as the bill goes through all the committees and to the Senate.”

In the interim, Donovan of the PBGC Advocate office says her agency has a “technical roadmap” for the pension registry that it’s creating with the General Service Administration’s Centers of Excellence. But it’s a “multi-phased project,” so there is no hard date for when the pension search service will be up and running.

Sam Semilia said such reforms are long overdue. Reflecting back on the four-year hunt for the money he was owed, he wistfully noted, “A pension search tool would’ve been nice.”

– – –

John F. Wasik is a writer for RealClearInvestigations.