U.S. mortgage rates rose to an almost six-month high toward the end of 2024, according to the Mortgage Bankers Association (MBA).

Read MoreTag: inflation

Fake News-a-Palooza: 50 Examples of Media Misdirection and Manipulation

Reflecting back on 2024 and looking forward to a future with less misinformation and more facts, Just Facts has summarized 50 false or misleading claims spread by journalists, commentators, and so-called fact checkers during the past year.

Read MoreCommentary: Reducing Housing Costs

Can Donald Trump reduce house prices?

A recent study by Redfin found that millions of Americans are skipping meals, selling belongings, and even delaying medical care to afford housing. Three in four Americans making less than $50,000—nearly half of Americans make less than $50,000—say they “regularly struggle” to keep a roof over their head.

Read MorePrices Rose over 20 Percent Under Joe Biden’s Administration

President Joe Biden is only a few weeks away from the end of his time in office, and one key part of his legacy is undeniable: inflation.

Biden has battled inflation from the start, but critics say he helped fuel it with trillions of dollars in deficit spending during his four years in office. Federal debt spending is offset in part by printing money, which increases inflation.

Read MoreCommentary: ‘Freedom Cities’ Could Be the Key to Unlocking America’s Future

We’ve all heard it: “You can’t make somethin’ out of nothin’.” Or so it would seem, though president elect Donald J. Trump appears destined to try if his plan to create new American cities out of currently mostly barren federal lands ever comes to fruition.

Read MoreAnalysis: Unemployment Ticks Up Another 161,000 in November

The unemployment rate in the U.S. ticked upwards to 4.2 percent in November, with 161,000 additional Americans saying they are unemployed in the latest household survey by the Bureau of Labor Statistics.

Read MoreCommentary: DOGE’s Greatest Christmas Gift Is the Disassembly of the Government Mindset

All I want for Christmas is a DOGE!

While this isn’t a typical holiday request – more likely people would prefer a furry, friendly kind of animal who greets them at the door to a static, cold, unfeeling stack of program cancellation papers – this year, in 2024, The Department of Government Efficiency (DOGE) is all the rage simply because the new non-government advisory board will bring something new and novel to the Washington swamp, an entity focused on cleaning up the gargantuan fiscal mess in the nation’s capital rather than bent on creating new complications.

Read MoreReport: Average American Household Has More than $10,000 in Credit Card Debt

The average American household credit card balance as of the third quarter of 2024 was about $10,757 after adjusting for inflation, according to a new study.

The personal-finance website WalletHub on Friday released its new Credit Card Debt Study, which found that consumers added $21 billion in debt during the third quarter of 2024.

Read MoreHarvard Economist Warns of ‘Resurgence of Inflation’

Federal pricing data released this week for consumer and producer prices shows that inflation rose last month.

Harvard professor and former economic advisor to President Barack Obama Jason Furman said the consumer data could show a “resurgence of inflation” not to the ultra high levels in recent years but to more recent elevated data.

Read MoreInflation Ticks Up Despite Slowdown in Jobs Market

Inflation rose slightly in October despite a massive slowdown in job growth in the same month, according to a Bureau of Labor Statistics (BLS) report released Wednesday.

Read MoreTrump Open to Reparations Fund for Victims of Crimes Committed by Illegals

Gaining momentum two weeks from Election Day, Donald Trump is laser focused on voters’ top priority of making America safe and affordable again. But after spending hours comforting families victimized by murder, rape and other border crimes, the former president told Just the News he also is open to creating a federal compensation fund for Americans harmed by illegal immigrants let into the country under President Joe Biden and Vice President Kamala Harris.

The idea of a border crimes reparations fund like the one created for the victims of the Sept. 11, 2001 terror attacks has been floating around conservative circles for months, including in Congress where Rep. Virginia Foxx, R-N.C., even introduced the concept before it stalled.

Read MoreCommentary: Democrats’ Economic Elitism

Democrats’ display their elitism by using macroeconomic numbers to ignore America’s microeconomic concerns. By promoting the macro-economy, Democrats produced the numbers they now campaign on. However, their macro numbers have come with high inflation that has wreaked havoc on the micro-economies in which most Americans live.

Democrats’ embrace of the macro economy is unmistakable. Paul Krugman’s recent column (10/8) trumpeted that the “macro” numbers “vindicate Bidenomics.” During CBS’s Sunday (10/6) 60 Minutes interview, Kamala Harris immediately ducked into the macro economy when asked about inflation’s impact on Americans.

Read MoreSmall Businesses’ Uncertainty Hits New High, Survey Finds

American small business uncertainty hit an all-time high and optimism remains low just weeks before Election Day, according to the latest survey.

The National Federation of Independent Businesses on Monday released the survey, which showed small business uncertainty rose last month to the highest level ever recorded by NFIB.

Read MoreInflation Ticks Down Less than Expected as Fears of Hot Economy Grow

Inflation fell slightly in September amid fears of a hotter-than-expected economy following strong job gains in the month prior, according to the latest Bureau of Labor Statistics (BLS) release Thursday.

The consumer price index (CPI), a broad measure of the price of everyday goods, increased 2.4% on an annual basis in September and rose 0.2% month-over-month, compared to 2.5% in August, less than the 2.3% rate that was expected, according to the BLS. Core CPI, which excludes the volatile categories of energy and food, rose 3.3% year-over-year in September, compared to 3.2% in August.

Read MoreFormer RNC Political Director Creates Tool for Voters to See Cost of Living Changes Over the Years

Former political director of the National Republican Convention Gentry Collins discussed the creation of a new tool for undecided voters to use when determining who to vote for in the upcoming 2024 election.

Read MoreEconomic Growth, Consumer Spending Rises Three Percent in Second Quarter

Gross domestic product rose at an annual rate of 3% in the second quarter of 2024, showing economic growth and increased consumer spending, according to a report.

The report, released by the U.S. Bureau of Economic Analysis, shows gross domestic product over the last five years.

Read MoreExisting Home Sales Slip 2.5 Percent in August as Prices Climb

Existing home sales fell in August, while sale prices continued to climb, according to the latest report from the National Association of Realtors.

Existing home sales fell 2.5% in August to a seasonally adjusted annual rate of 3.86 million. That’s down 4.2% from one year ago.

Read MoreCommentary: Americans Support Trump on the Election’s Two Most Important Issues

As the nation reels from a second cowardly attack on former President Donald Trump’s life, it is increasingly clear the radical left refuses to tone down their hateful rhetoric against Trump even if it threatens his life repeatedly. The American people, however, want to put Trump back in charge of the two most pivotal issues facing the country – the economy and immigration.

Just five days after the contentious debate between former President Trump and Vice President Kamala Harris blatantly exposed the mainstream media’s allegiance to the radical left, Trump fended off yet another attack on his life. On Sunday Trump was on what should have been a secure West Palm Beach golf course, only to be threatened once again by a radical extremist with a weapon.

Read MoreInflation Rate Inches Down as Economy Continues to Slow

Inflation fell in August amid fears of an economic slowdown following two straight months of disappointing job gains, according to the latest Bureau of Labor Statistics (BLS) release on Wednesday.

The consumer price index (CPI), a broad measure of the price of everyday goods, increased 2.5% on an annual basis in August and rose 0.2% month-over-month, compared to a 2.9% year-over-year rate in July, according to the BLS. Core CPI, which excludes the volatile categories of energy and food, rose 3.2% year-over-year in August, compared with 3.2% in July.

Read MoreCommentary: Kamala Harris Would Shatter America’s Labor Market Already Showing Cracks

Friday’s jobs report reveals accelerating weakness in the American economy. Only 142,000 jobs were created last month, below expectations. Half of new positions were created in the unproductive government or quasi-government healthcare and social services sectors.

A record 8.2 million Americans have second jobs. So far this year, the number of unemployed Americans has increased by one million.

Read MoreEconomy Added Fewer Jobs than Expected in August as Unemployment Falls

Economists anticipated that the country would add 161,000 nonfarm payroll jobs in August compared to the 114,000 added in initial estimates for July, and that the unemployment rate would fall to 4.2%, according to MarketWatch. The job gains follow a disappointing July report and a downward revision of over 800,000 jobs that the Biden administration had claimed to create between April 2023 and March 2024.

Meanwhile, previously reported job gains for July were revised down from 114,000 to 89,000 while gains for June were lowered from 179,000 too 118,000.

Read MoreAs Prices Soar, Americans Forced to Choose Between Food and Energy

With inflation remaining stubbornly high, many Americans have been forced to choose whether to pay for more groceries to feed their families, or to pay their energy bills to keep their families cool in the summer and warm in the winter.

According to CBS News, this new trend has been referred to as “energy poverty,” when Americans are unable to pay their energy bills or otherwise afford utilities. On average, households that spend 6 percent of their income or more on energy bills alone are considered to be in “energy poverty.” Currently, 1 in 7 American households spend approximately 14 percent of their income on energy.

Read MoreFed Chair Powell Indicates Bank Ready to Start Cutting Its Key Interest Rate

Federal Reserve Chairman Jerome Powell on Friday indicated the bank is prepared to start cutting its key interest rate from its 23-year high, as inflation falls to more historic rates and the job market cools.

Read MoreCritics Blast Harris’ New ‘Price Control’ Plan

Vice President and presumptive Democratic presidential nominee Kamala Harris is taking fire for her new “price-gouging” ban that critics say is little more than communism-style “price controls” where government heavily regulates industries.

Harris’ effort to address elevated consumer prices hits at a key pain point for Americans, but the details of how Harris plans to go about fixing that problem will be the subject of close scrutiny when she lays out the plan at a North Carolina rally Friday. Harris is expected to unveil a broader economic plan at the same rally, but so far there are few details on specifically how she will address inflation. Prices have risen more than 20% overall since she and President Joe Biden took office.

Read MoreCommentary: The Weird, Creepy, Surreal—and Dangerous—2024 Campaign

The already-long 2024 presidential campaign has become the strangest in modern history.

Here are ten unanswered questions that illustrate how and why we’ve entered this bizarro world:

Read MoreAnalysis: June Unemployment 352,000 Under Biden-Harris, 1.47 Million Unemployed Since 2023

The U.S. unemployment rate once again ticked up in the month of June to 4.3 percent as another 352,000 Americans said they were unemployed, according to the latest data from the Bureau of Labor Statistics. Markets are crashing in response.

Read MoreShoplifting Rose Twenty-Four Percent This Year, No End in Sight

Shoplifting has soared in the U.S. in 2024, forcing many stores to leave cities and continuing a trend in recent years.

Shoplifting has risen 24 percent in the first half of 2024 alone, according to newly released data from the Council on Criminal Justice.

Read MoreFederal Reserve Declines to Cut Rates Yet Again as Americans Wait for Relief

The Federal Reserve announced on Wednesday that it will not yet cut its benchmark federal funds rate in what is predicted to be the last in a streak of pauses as inflation and debt continues to cripple Americans.

Read MoreAs Inflation and Labor Cools, Traders Look to the Fed for Hints at a September Rate Cut

The Federal Reserve is expected to hold the bank’s key interest rate steady this week. Traders currently expect three rate cuts this year beginning in September.

Read MoreKamala Harris’ Direct Connection to Bidenflation: a Tie-Breaking Senate Vote for Stimulus Package

Vice President Kamala Harris cast the tie-breaking vote in the Senate for the first COVID-19 stimulus package in 2021 which led to inflation, in what critics call a sign of what’s to come in a possible Harris administration.

Harris, who is the President of the Senate, has cast the most tie-breaking votes in the Senate of any vice president, a total of 33 thus far. Her second tie-breaker was for the stimulus package at the beginning of the Biden administration, which has significantly impacted the economy, as inflation has skyrocketed.

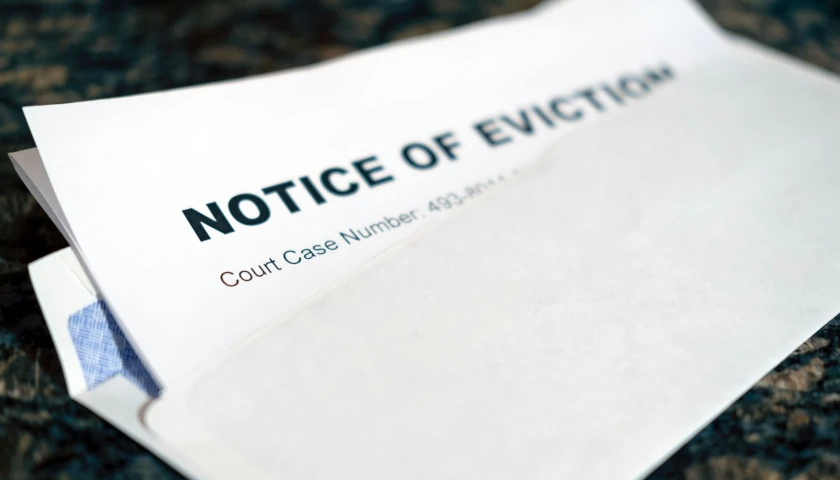

Read MoreCommentary: Government Policies are Exacerbating Evictions

Evictions are soaring, and Americans can’t pay the rent, potentially throwing hundreds of thousands of families out of their homes at a time when homeless shelters are jammed to the rafters with 10 million illegal immigrants.

It’s a useful reminder that the problem with our ruling elite isn’t just President Joe Biden’s dementia. They’ve made a very big bed we’re all going to be lying in.

Read MoreCommentary: The Big Divide

Whether the economy is currently bubbling along or facing a slowdown, a slow-motion disaster is about to create a real crisis for the government, our future politics, and the shrinking middle class. Half of households have no retirement savings.

This is just one of many shifts in the economy that reflect the declining fortunes of the middle class. Wages have remained mostly flat for most workers—particularly those without a college degree—since the early 1970s. Recent high rates of inflation further cut into the ability of the self-identified middle class to make ends meet. But the biggest change has been the abolition of employer-provided pensions and their replacement with rickety and self-managed 401k savings plans.

Read MorePoll: Inflation, Immigration, Economy Are Top Concerns of Voters

The Center Square Voters’ Voice Poll, conducted prior to the weekend assassination attempt on former President Donald Trump, found that likely voters said inflation/price increases (45%), illegal immigration (36%) and the economy/jobs (28%) were the issues that matter most to them heading into the November election.

The poll was conducted in conjunction with Noble Predictive Insights from July 8-11 and surveyed nearly 2,300 likely voters, including 1,006 Republicans, 1,117 Democrats, and 172 true (non-leaning) independents. It has a margin of error of 2.1%. The Center Square Voters’ Voice Poll is one of only six national tracking polls in the United States.

Read MoreCommentary: The Biden Titanic

Joe Biden’s escalating dementia and the long media-political conspiracy to hide his senility from the public are the least of the Democrats’ current problems.

Biden’s track record as president may be more concerning than his cognitive decline. He has literally destroyed the U.S. border, deliberately allowing the entry of more than 10 million illegal aliens. His callous handlers’ agenda was to import abjectly poor constituencies in need of vast government services without regard for the current struggles of a battered American middle class and poor.

Read MoreSmall Businesses Worry About Inflation, Survey Shows

Small businesses cite inflation as their number one concern, according to new survey data.

The National Federation of Independent Businesses released the survey results Tuesday, which show that 21% of small business owners cite inflation as “the single most important problem in operating their business,” more than any other issue.

Read MoreInflation Falls Below Expectations as Economy Cools

Inflation ticked down slightly year-over-year in June as rising prices continue to weigh on average Americans’ finances, according to the latest Bureau of Labor Statistics (BLS) release on Wednesday.

The consumer price index (CPI), a broad measure of the price of everyday goods, increased 3.0 percent on an annual basis in June and decreased 0.1 percent month-over-month, compared to 3.3 percent in May, according to the BLS. Core CPI, which excludes the volatile categories of energy and food, remained high, rising 3.3 percent year-over-year in June, compared to 3.4 percent in May.

Read MoreUnemployment Rate Climbs for Another Month as Job Gains Slump

The U.S. added 206,000 nonfarm payroll jobs in June as the unemployment rate ticked up to 4.1%, according to Bureau of Labor Statistics (BLS) data released Friday.

Economists anticipated that 190,000 jobs would be added in June, far fewer than the initially reported 272,000 gain seen in May, and the unemployment rate would remain steady at 4%, according to U.S. News and World Report. Strong topline job gains in recent months have led some top economic officials, like Federal Reserve Chair Jerome Powell, to push back against claims that the economy is stalling, despite slow economic growth and high inflation.

Read MoreReport Shows 61 Percent of Renters Can’t Afford Median Apartment Rate in U.S.

Due to inflation eating away at earnings and less supply of affordable housing, the majority of Americans today cannot afford median rent prices, according to a new report by the real estate company Redfin.

The analysis comes as other reports indicate that both homeowners and renters are struggling with high housing costs due to inflationary pressures, an inflated housing market, low supply and demand for affordable housing.

Read MoreHome Prices Under Biden Reaches New Milestone

Home prices hit a record high in May despite falling demand and sales activity, The Wall Street Journal reported on Friday.

The national median home price in the United States is now $419,300, a 5.8% increase from a year earlier and a new record high, according to the The Wall Street Journal. The record high comes as homeowners remain unwilling to list due to high mortgage rates.

Read MoreInflation Slows Slightly, but Cost of Some Goods, Services Climbs

Newly released federal inflation data showed that inflation slowed in recent weeks.

The U.S. Bureau of Labor Statistics released its Consumer Price Index, which showed that overall consumer prices paused in the month of May after rising 0.3 percent in April.

Read MoreFederal Reserve Keeps Key Interest Rate, Signaled Just One Cut Is Expected Before Year’s End

The Federal Reserve on Wednesday kept its key interest rate but signaled one cut is expected before the end of the year.

Read MoreVast Majority of Small Business Owners Worried Biden’s Economy Will Force Them to Close

A large portion of small business owners are concerned about their future amid wider financial stress under President Joe Biden, according to a new poll from the Job Creators Network Foundation (JCNF) obtained exclusively by the Daily Caller News Foundation.

Around 67 percent of small business owners were worried that current economic conditions could force them to close their doors, ten percentage points higher than just two years ago, according to the JCNF’s monthly small business poll. Respondents’ perceptions of economic conditions for their own businesses fell slightly in the month, from 70.2 to 68.1 points, with 100 points being the best possible business conditions, while perceptions of national conditions increased from 50.4 to 53.2 points.

Read MoreMedia Blame Climate Change for Soaring Insurance Rates, but Data Doesn’t Support Narrative

Homeowners across the U.S. are seeing skyrocketing insurance rates, increased deductibles, excluded protections, and canceled policies.

Insurers say that they’re having to adjust to changing conditions to remain profitable. Among the problems they blame is inflation, rising construction costs, and costs associated with regulatory compliance. But many insurers are also blaming climate change for driving extreme weather events and increasing losses, and much of the media coverage is zooming in on this narrative.

Read MoreSmall Business Owners Lament Inflation

As inflation continues to rise this year, small businesses are feeling the pain.

The National Federation of Independent Businesses released a survey of small business owners Tuesday that found the nation’s job creators cite inflation as their top concern more than any other issue.

Read MoreInflation Stays High as Rising Prices Continue to Squeeze Americans

Inflation ticked down slightly year-over-year in April but still remained high as rising prices continue to take a toll on average Americans’ finances, according to the latest Bureau of Labor Statistics (BLS) release on Tuesday.

The consumer price index (CPI), a broad measure of the prices of everyday goods, increased 3.4% on an annual basis in April and 0.3% month-over-month, compared to 3.5% in March, according to the BLS. Core CPI, which excludes the volatile categories of energy and food, remained higher, rising 3.6% year-over-year in April, compared to 3.8% in February.

Read MoreProducer Inflation Makes Biggest Jump in a Year in Potential Warning Sign for Future Economy

A measure of wholesale inflation that tracks prices before they reach consumers surged to its fastest annual rate since April 2023, according to new data released Tuesday by the Bureau of Labor Statistics (BLS).

The producer price index (PPI) rose 0.5 percent in April, totaling a 2.2 percent annual rate, far higher than estimates that the index would rise 0.3 percent in the month, according to the BLS. The report adds to fears that inflation is once again surging following the consumer price index jumping to 3.5 percent in March, up from 3.2 percent in February and far from the Federal Reserve’s 2 percent target.

Read MoreBidenomics Tips More Stressed U.S. Banks Into Danger Zone as Economy Slows

With inflation, high-interest rates and slowing economic growth already stressing Americans heading into the 2024 election, another reason to worry about the Biden economy has cropped up: distressed banks in danger of failing.

Last month U.S. regulators seized a bank known as Republic First Bancorp and agreed to sell it to Fulton Bank.

Read MoreAmericans Less Confident About Economy, Poll Shows

Americans are less confident about the economy, according to a new survey.

Gallup’s recently released economic confidence rating dropped from March to April as inflation remains elevated. Just after the polling was conducted from April 1-22, the federal government released underperforming Gross Domestic Product data.

Read MoreAmericans Increasingly Turning to Discount Grocer Amidst Rising Prices

A German discount grocer has seen an increase in business from American customers over the last year, as inflation remains stubbornly high and presents an ongoing threat to Americans’ financial security.

The Daily Caller reports that Aldi, the German-based grocer, saw a staggering 26% increase in foot traffic at its store in March compared to March of 2023. This rise far surpassed increases at other popular grocery store chains, including the 6% year-over-year increase at Kroger and the 15% increase at Trader Joe’s.

Read MoreCompanies are Slashing Away at Debt as Surging Inflation Casts Shadow over Interest Rate Cuts

Many companies are looking to cut down on their debts as recent high inflation reports have made borrowing more expensive as the prospect of interest rate cuts by central banks diminishes, The Wall Street Journal reported Wednesday.

Even companies with already high credit outlooks are deleveraging to boost their rating with top agencies and reduce debt costs that have increased along with interest rates, while firms with lower ratings are needing to cut debt to maintain profitable operations, according to the WSJ. Investors have had to adjust their view about when interest rates might decline in recent weeks as persistently high levels of inflation have made it less likely that central banks around the world, including in the U.S., will cut interest rates, reducing the cost of holding debt.

Read More