As you near retirement, you must make smart choices with your 401(k) plan. This is especially important for baby boomers born between 1946 and 1964. For a secure retirement, avoiding mistakes and maximizing growth opportunities is crucial. Here are some common mistakes people make with 401(k) plans and solutions to improve retirement prospects.

Read MoreTag: retirement

Border Patrol Facing Loss of Agents from Retirement, Flat Recruitment as Border Crisis Intensifies

The nearly 10,000 border patrol agents eligible for retirement by 2028 and static recruitment numbers threaten to undermine future efforts to secure the Southern border, even as the current immigration crisis escalates.

By 2028, a total of 9,828 current border patrol agents will be eligible for retirement, according to numbers provided to Transport Dive by a Customs and Border Protection official. The agency, which has been plagued by a recruitment shortfalls for years, says it is preparing to deal with the fallout if even a fraction of the eligible agents retire on schedule.

Read MoreCommentary: Top 10 Financial Landmines to Avoid Before and During Retirement

Planning for retirement is a crucial aspect of financial well-being. However, there are several financial landmines that individuals must navigate to ensure a secure and comfortable retirement.

Read MoreStudy: More Americans over the Age of 65 are Heading Back to Work

A new study released on Thursday by the Pew Research Center reveals that a rising number of Americans over the age of 65, the normal age for retirement, are heading back to work to earn higher wages.

According to Axios, the number of older Americans returning to the workforce has been consistently rising since the late 1980s, with one major decline during the Chinese Coronavirus pandemic. Some of the reasons for this increasing return to work include changes in Social Security law forcing older Americans to keep working even past 65 in order to receive their full benefits; additionally, there has been a shift away from pension plans that normally would force most Americans to retire by a certain age, in favor of 401(k) plans that allow for ongoing workforce participation.

Read MoreCommentary: Our Republic Endures Only When Political Enemies Can Retire in Peace

Sometime during the latter part of the 18th century politics took an unprecedented turn in the English-speaking world: it ceased to be dangerous. Although little appreciated by scholars for its historical consequence, perhaps because it consisted of non-consequences, things that didn’t happen, it was essential to the development of modern democracy. Up to that point, in just about every time and place, politicians who lost high office, or failed in grasping at it, faced the possibility of imprisonment, confiscation, exile or death. Now in Britain and America, then increasingly elsewhere in Europe, and eventually in places even further afield, loss of office, while not pleasant, was no longer lethal.

Read MoreCommentary: Issues with 401(k)s

Fretting over your 401(k) lately? For all the current turbulence in these retirement plans – from their rocky recent market performance to asset managers’ politicization of their investments through the “environment, social and governance” agenda – the main problem lies in their flawed design decades ago, a range of retirement experts say.

Read MoreHouse Republicans Vow to Investigate Anthony Fauci After Resignation

On Monday, Republican members of the powerful House Oversight Committee announced their intentions to pursue investigations of Dr. Anthony Fauci when they reclaim the majority, even after Fauci announced his plans to step down in December.

As reported by The Daily Caller, Fauci will be leaving his positions at the White House, the National Institute for Allergy and Infectious Diseases (NIAID), and the National Institutes of Health (NIH) in December, after spending 38 years in government. The 81-year-old Fauci said that he will remain active in public health to some degree, and that after leaving government he will enter the “next chapter” of his career.

Read MoreQuarter of Americans Will Delay Retirement Because of Inflation, Survey Says

Millions of Americans say the likely will have to push back their retirement because of rising inflation, newly released financial survey data found.

The BMO Real Financial Progress Index, a quarterly survey from BMO and Ipsos, showed that a quarter of Americans will likely need to delay their retirement because of higher prices.

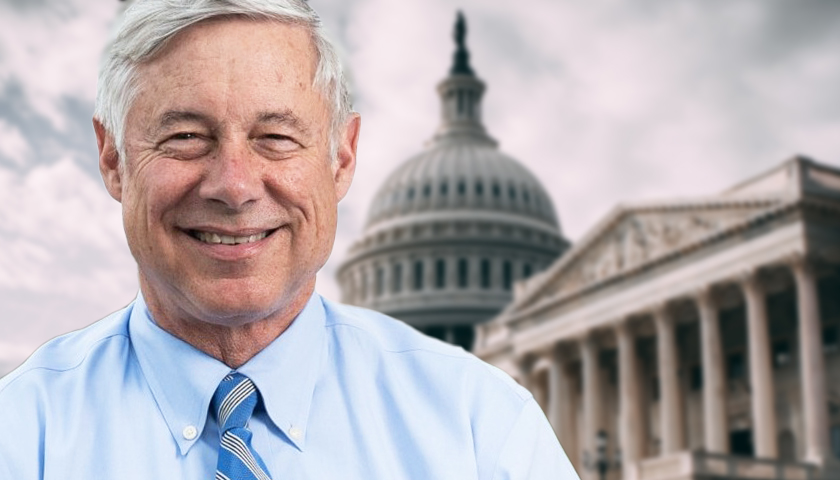

Read MoreMichigan Congressman Fred Upton Announces Retirement at End of Term

Congressman Fred Upton (R-MI-06) announced his retirement at the end of his current term on the House floor in a speech to his colleagues.

The Michigan lawmaker has served in the House of Representatives since 1987.

Read MoreTom Brady Ends Retirement, Will Join Tampa Bay Buccaneers in 2022

Football legend Tom Brady has reversed his decision to retire and now plans on joining the Tampa Bay Buccaneers for the 2022 season.

“These past two months I’ve realized my place is still on the field and not in the stands. That time will come. But it’s not now,” Brady tweeted Sunday evening.

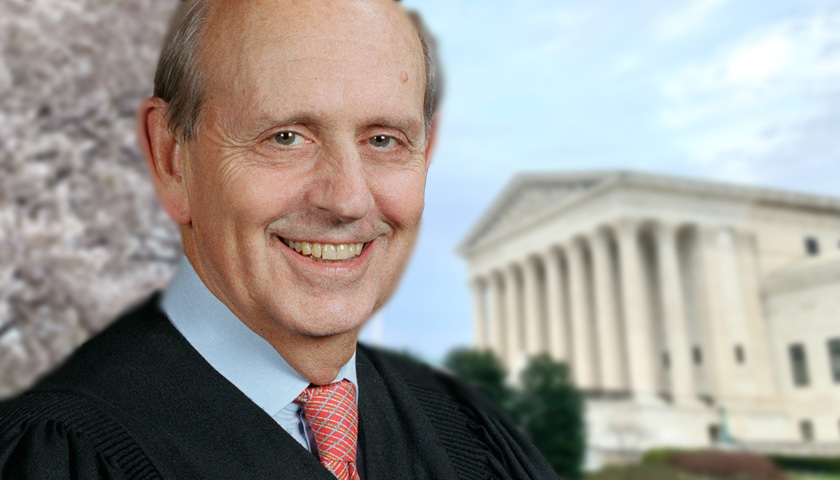

Read MoreJustice Breyer to Retire From Supreme Court: Report

Supreme Court Justice Stephen Breyer will step down from his post at the end of the court’s current term, according to a report from NBC News.

Breyer is one of the three remaining Democrat-appointed justices on the high court. Should he retire, it will present President Biden with an opportunity to appoint a liberal-leaning justice who could sit on the court for many years to come, and for the moment, preserve the 6-3 split between conservative-leaning and liberal-leaning justices.

Breyer, who is 83, is the oldest member of the court. He had faced consistent pressure from liberal groups to retire, especially following the death of Justice Ruth Bader Ginsburg, whose passing allowed then-President Donald Trump to appoint Justice Amy Coney Barrett.

Read More‘Effectively Overcharges Seniors’: AARP Rakes in Record Profits Selling Brand Royalties While Overcharging Members

The American Association of Retired Persons (AARP) raked in massive profits in 2020, mostly from royalties on branded health insurance policies, not memberships, according to company financial documents.

AARP’s 2020 Form 990 shows that the organization reported $1.6 billion in revenue, with roughly $1 billion, or over 60%, from royalty revenue. Meanwhile, membership dues contributed under 20% of total revenue.

AARP’s 2019 Form 990 reported $1.72 billion in revenue, with royalties making up nearly 56% of revenue while membership dues contributed just 17%.

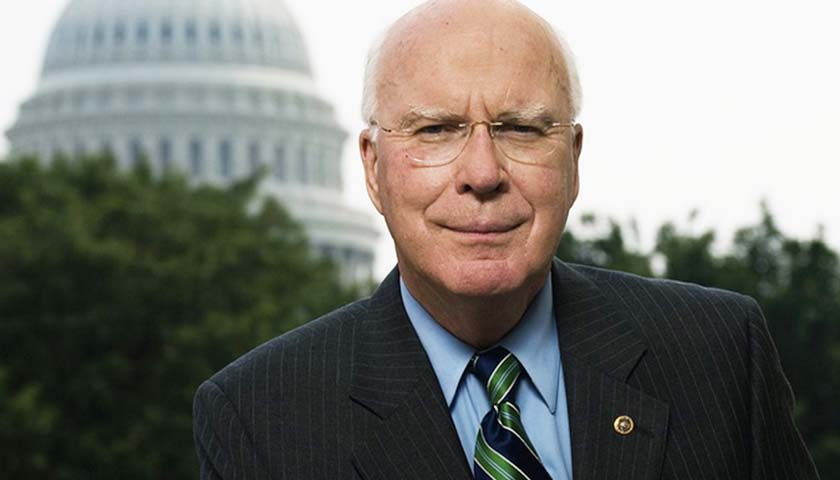

Read MorePatrick Leahy, Vermont Senator Since 1975, Announces Retirement

Vermont Democratic Sen. Patrick Leahy announced his retirement Monday morning in his home state.

Leahy, 81, was first elected in 1975 and is in his eighth term. He is the president pro tempore of the Senate, making him third in the line of presidential succession after Vice President Kamala Harris and House Speaker Nancy Pelosi, and he is the chamber’s longest-serving member.

Read More‘I’ll Make a Decision’: Justice Breyer Weighs in on His Potential Retirement

Supreme Court Justice Stephen Breyer remains undecided about retirement plans, saying in an interview published Friday that there are “many considerations” playing a part in his eventual decision.

Breyer, 83, is the oldest member of the court, and he has yet to decide when to retire, despite increasing pressure from activists to retire immediately.

Read More