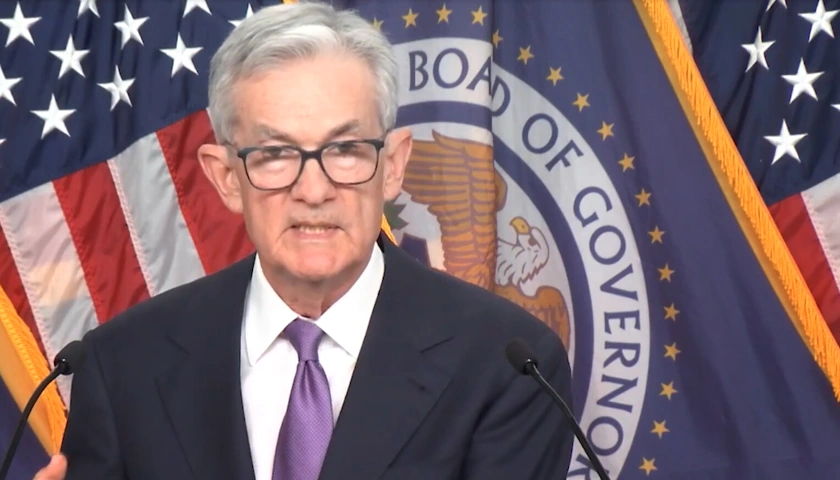

The Federal Reserve is expected to hold the bank’s key interest rate steady this week. Traders currently expect three rate cuts this year beginning in September.

Read MoreTag: The Federal Reserve

Economists: Housing Costs to Remain Elevated for Foreseeable Future

Americans looking to buy a home may have to wait as housing costs are expected to remain elevated until 2026 or later, according to a note from Bank of America (BofA) economists published Monday.

Homebuyers are facing elevated interest rates due to sky-high inflation under President Joe Biden and a housing shortage exacerbated by the COVID-19 pandemic that has led Americans to be hesitant to move, according to BofA. As a result, economists at the bank expect home prices to rise a total of 4.5% throughout the course of 2024 and another 5.0% throughout 2025, before easing slightly in 2026.

Read MoreCommentary: Wokeness Is Hollowing Out The Fed

Are you wondering why checking out at the grocery store these days feels like making a mortgage payment? This week’s four-decade-high inflation is a direct result of the Federal Reserve taking its eye off the ball over the last two years. Instead of focusing on its mandate of keeping prices stable, it has been more concerned with financing massive federal deficits and kowtowing to liberal ideology.

But now the Fed chair is claiming just the opposite.

Read MoreCommentary: The Treacherous Road to Runaway Inflation

In January, 2001, America had a balanced budget, low debt, and was at peace. Here, briefly, is what lay ahead: war, financial crisis, civil unrest, massive growth of the federal government, and now severe inflation.

Never in the history of America has our government in its ineptitude created such a false economy, risking hundreds of years of hard work on unsound and unworkable economic policies. The Founders wisely relied on dispersion of power. They knew there would be dishonest and incompetent politicians but, in this case, the entire government is infected with deceptive leaders.

Read MoreInflation Crisis: Consumer Prices Surge 5.4 Percent, Led by Food and Energy Costs

Inflation increased at a rapid 5.4% clip compared to August 2020, the Department of Labor said Wednesday.

The Consumer Price Index (CPI), a common tool used to measure inflation, increased 0.5% between June and July, according to the Labor Department report.

Read MoreFed to Keep Providing Aid and Sees No Rate Hike Through 2022

Confronted with an economy gripped by recession and high unemployment, the Federal Reserve signaled Wednesday that it expects to keep its key short-term interest rate near zero through 2022.

At the same time, the Fed said it will keep buying about $120 billion in Treasury and mortgage bonds each month to maintain low longer-term borrowing rates in an effort to spur spending and growth.

Read More