Another powerful House chairman struck closer to President Joe Biden, vowing to send a criminal referral asking asking prosecutors to charges first son Hunter Biden with lying to Congress.

Read MoreTag: House Ways and Means Committee

CIA Prevented Investigators from Interviewing Hunter Biden Lawyer, New IRS Whistleblower Docs Say

A new cache of documents from the IRS whistleblowers released Wednesday by the House Ways and Means Committee show how the Central Intelligence Agency directly intervened to prevent the IRS investigators from interviewing Hunter Biden lawyer and benefactor Kevin Morris.

The CIA’s involvement in the case was first suggested in earlier this year when the House Judiciary and Oversight Committees wrote a letter to Director William Burns that revealed impeachment investigators had at least one whistleblower who alleged the spy agency tried to interfere with a witness interview in the case, Just the News previously reported.

Read MoreThe 2024 Sunset of the Trump Tax Cuts Becoming Election Year Issue as Inflation, Cost of Living Climbs

The sweeping Trump-era tax cuts in the Tax Cuts and Jobs Act of 2017 are set to expire next year, setting up the tax debate as a potentially key political issue this election year.

While illegal immigration and inflation top Americans’ list of concerns, both parties are increasingly talking about the Trump-era tax cuts, which President Joe Biden has said he will allow to expire next year.

Read MoreCongress to Leverage ‘Power of the Purse,’ Taking Aim at Big Education Amid Ugly Campus Riots

The debate in Congress over federal funding of education dates to the days of Thomas Jefferson, but for the first time since Jimmy Carter created the U.S. Education Department a large number of lawmakers are now openly discussing cutting funding and changing the tax code to punish universities that have failed to quell anti-Israel riots and force a shift from the far-left ideologies that have taken root on most campuses.

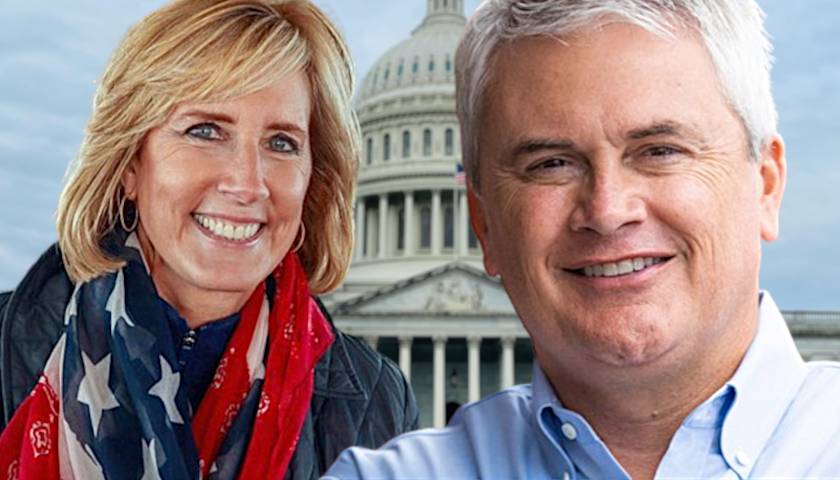

“I think that the American people are pretty outraged about this, and they expect the Republicans in Congress to respond in kind with the power of the purse,” House Oversight Committee Chairman James Comer told the “Just the News, No Noise” television show last week after visiting the protest-wracked George Washington University campus.

Read MoreWeiss Acknowledges ‘Ongoing Investigation’ in Biden Tax Case, Spurring Congressional Probe

In the legal back-and-forth between Hunter Biden’s defense team and prosecutor Special Counsel David Weiss, the government appeared to acknowledge in court filings the existence of an ongoing investigation as part of the Hunter Biden tax investigation.

The government said in a request to seal certain documents that “The justification for the redaction and the sealed exhibits is that the redacted information contained in the filing and the sealed exhibits relates to a potential ongoing investigation(s) and the investigating agency(cies) specifically requested that the government request that the court seal the exhibits, as well as any accompanying reference in the pleading, in order to protect the integrity of the potential ongoing investigation(s).”

Read MoreIRS Blistered by Internal Watchdog for Lax Protections of Taxpayer Data after Criminal Leak

The IRS failed to revoke access to sensitive tax systems from contractors who failed background checks and doesn’t have protections for some of those systems to prevent unauthorized removal of taxpayer data, the agency’s chief watchdog warns in a stinging rebuke that comes on the heels of a devastating criminal leak of tax records.

“The fact remains that for some sensitive systems, the IRS does not have adequate controls to detect or prevent the unauthorized removal of data by users,” the Treasury Department Inspector General for Tax Administration (TIGTA) concluded in a report this month.

Read MoreCongress Reaches Deal to Increase Child Tax Credit, Negotiate Tax Treaty with Taiwan

Congressional negotiators from the Senate and House of Representatives announced a deal on Tuesday to increase the child tax credit and negotiate a new bilateral tax treaty with Taiwan, among other matters.

The child tax credit was first enacted in 1997 to provide parents with greater funds to care for children under the age of 17 and was expanded in 2021 under the American Rescue Plan Act, though that expansion expired in 2022 and has not been reauthorized. The new deal — known as the “The Tax Relief for American Families and Workers Act of 2024” — reached between Democrats and Republicans in Congress will change the way the tax credit is calculated, increase the credit every year until 2025 and index it to inflation, according to a technical summary of the plan published by the House Ways and Means Committee.

Read MoreNew Legislation Would Revoke Tax-Exempt Status of Nonprofits Funding Hamas, Other Terrorists

Proposed new legislation would revoke the tax-exempt status of any nonprofit organization that is providing material support for terrorist groups.

The bipartisan bill, introduced by U.S. Rep. David Kustoff, R-Tenn., and U.S. Rep. Brad Schneider, D-Ill., comes out of the House Ways and Means Committee, which unanimously approved the legislation last week.

Read MoreImpeachment Inquiry Sharpens Focus on Millions in Loans to Biden Family

There are red flags aplenty: Loan repayments between Joe Biden and his brother; millions in promissory notes between Hunter Biden and a Democrat-donating Hollywood lawyer; and debt deals from Ukraine to China.

As the House impeachment inquiry heats up, investigators are increasingly focused on a trail of red ink that has become a recurring theme in evidence chronicling the first family’s finances.

Read MoreCommentary: Oh Great, Another ‘Debt Commission’

Recognizing the precarious plight of the nation’s fiscal situation, newly installed House Speaker Mike Johnson has called for a bi-partisan commission to study the nation’s debt. Everyone involved in federal fiscal policy for a length of time surely responded with some variation on, “Good grief, Charlie Brown.” Congress has formed and ignored innumerable such groups over many decades.

Read MoreCommittee Docs Shed Light on Hunter Biden’s Escort Payments, Potential Mann Act Violations

The documents released by the House Ways and Means Committee last week shed new light on Hunter Biden’s reported interactions with escorts, including his claiming a tax deduction for payments to the women as business expenses. The documents also disclose documentation of investigators considering Mann Act charges.

Contained in the highly redacted documents the House Ways and Means Committee released last Wednesday are an interview with an “escort” identified as Gulnora and with Hunter Biden’s tax accountant who helped him prepare his tax returns for 2017 and 2018.

Read MoreCongress to Release New Evidence, Testimony in Biden Case to Back Up IRS Whistleblowers

The chairman of the powerful House Ways and Means Committee tells Just the News he plans to soon make public new testimony that corroborates IRS whistleblowers’ accounts of interference in the Hunter Biden probe and new evidence to support the nascent impeachment inquiry against President Joe Biden.

House Ways and Means Committee Chairman Jason Smith (R-Mo.) said Thursday his panel will hold a vote to make the new information available, including testimonies from two IRS agents who back the accounts of whistleblowers Gary Shapley and Joseph Ziegler about slow-walking and interference in the Hunter Biden tax case.

Read More‘Nothing But Retaliation:’ IRS Agent Details Adverse Career Impact After Blowing Whistle on Biden

After helping to recover billions in taxpayer funds from tax cheats, IRS agent Gary Shapley was rising in stature and responsibility. He was in line for a big promotion and his plans for a new project to pursue tax evasion around the globe were on the fast tracks.

But all that, he says, came crashing down after he and a fellow agent blew the whistle last October on what they saw as political tampering from the DOJ in a tax evasion case against first son Hunter Biden.

Read MoreIRS Whistleblower Attorneys Hit Back at Hunter Biden Attorney over Leaking Accusations

IRS Whistleblower Gary Shapley’s legal team hit back on Friday against accusations from Hunter Biden’s attorney suggesting he had claimed to be a whistleblower to escape punishment over his own alleged misconduct. Biden attorney Abbe Lowell on Friday wrote to House Ways and Means Committee Chairman Jason Smith, suggesting Shapley and a second unnamed IRS agent of blowing the whistle “in an attempt to evade their own misconduct,” Axios reported. The “timing of the agents’ leaks and your subsequent decision to release their statements do not seem innocent.”

Read MoreRecent IRS Controversies Raise Doubts About Auditing Army’s Potential Bias

President Joe Biden’s call for funding for 87,000 IRS agents to audit Americans has raised questions about whether the new rash of auditing will target poorer Americans or be politically motivated.

The Inflation Reduction Act included $80 billion to beef up IRS efforts, which Biden says will more than pay for itself in new audits.

Read MoreIRS Leaked Thousands of Americans’ Tax Filings; Congress Demands Answers

The new head of the powerful House Ways and Means Committee blasted the Biden administration for giving few answers after thousands of taxpayer files were leaked to an outside group.

House Ways and Means Chairman Rep. Jason Smith, R-Mo., sent a letter to Russel George, the Treasury Department’s Inspector General for Tax Administration, raising concerns about the leak of “confidential tax information” and the lack of accountability over that leak.

Read MoreU.S. House Committee Releases Trump’s Tax Returns

The House Ways and Means Committee that is controlled by Democrats released six years of former President Donald Trump’s tax returns on Friday.

The New York Post reported the returns cover the years 2015 to 2020. The Trumps reported positive income of $24.3 million in 2018 and $4.4 million in 2019 and had negative income in four of the six years in which tax returns were released.

Read MoreIG Reports ‘Historic’ COVID Unemployment Funds Lost, Congress Investigates

Reports indicate as much as $400 billion in COVID-19 unemployment relief were likely lost to waste and fraudsters. Lawmakers want answers.

Republicans on the House Ways and Means Committee sent a letter to the U.S. Department of Labor demanding documents and information related to the unemployment fraud.

Read More