As 2025 approaches, America’s fiscal health is in serious trouble with a ballooning federal debt exceeding 100% of the GDP.

Read MoreTag: national debt

National Debt Reaches $35 Trillion for First Time in U.S. History

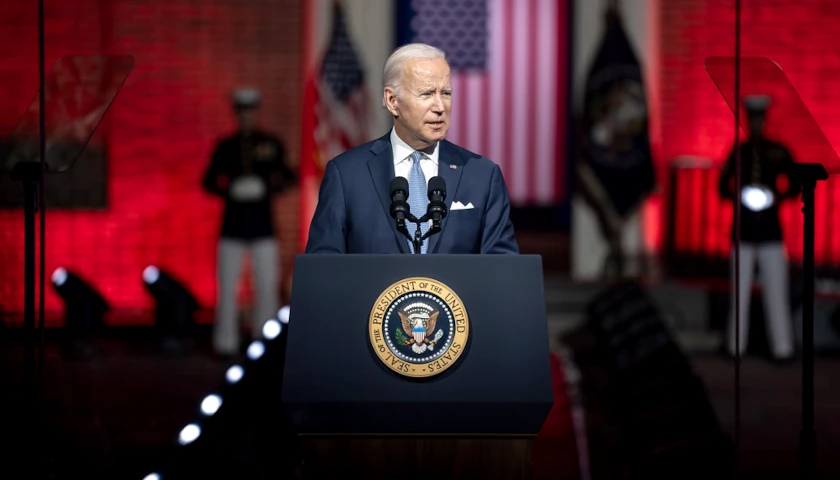

The national debt surpassed $35 trillion on Monday for the first time in U.S. history as exorbitant federal spending continues under President Joe Biden.

Since Biden was inaugurated, the national debt has increased by over $7 trillion, from $27.7 trillion on January 20, 2021 to now over $35 trillion as of July 29, 2024. If the debt were to be divided among the roughly 258.3 million adults in the U.S., each adult would have roughly $135,500.

Read MoreNational Debt Surpasses $34.9 Trillion for First Time in History

The national debt has surpassed $34.9 trillion for the first time in U.S. history.

It did so as the federal government’s “borrowing binge and spending spree continues,” EJ Antoni, an economist with the Heritage Foundation, said.

Read MoreCommentary: The Logic in All the Madness

by Victor Davis Hanson Most Americans believe it is unhinged to deliberately destroy the border and allow 10 million illegal aliens to enter the country without background audits, means of support, any claims to legal residency, and definable skills. And worse still, why would federal authorities be ordered to…

Read MoreForeign Aid and Student Loan Forgiveness Behind Massive Increase in Deficit Estimate, Congressional Budget Office Says

America’s debt is growing faster than previously expected, largely due to actions taken by the Biden administration and recent legislation, according to the Congressional Budget Office (CBO).

The United States’ projected deficit is $1.9 trillion for the 2024 fiscal year, $400 billion higher than it was projected to be in February, the CBO announced Tuesday. CBO analysts increased their estimate due in large part to the foreign aid package signed by President Joe Biden in April and his administration’s efforts to reduce student loan balances.

Read MoreCBO: U.S. Budget Deficit at $1.7 Trillion over Past Year

The nonpartisan Congressional Budget Office this week revealed the magnitude of the federal deficit, growing to $1.7 trillion in one year, as the national public debt reached $34.7 trillion for the first time in U.S. history.

On Monday alone, the national public debt grew by $37 billion. By Tuesday, it surpassed $34.7 trillion overall.

Read MoreAnalysis: RCM/TIPP Economic Index Slumps Again

The RealClearMarkets/TIPP Economic Optimism Index, a leading gauge of consumer sentiment, dropped sharply 3.1 percent in June to 40.5. Since September 2021, the index has remained in negative territory for 34 consecutive months. June’s reading of 40.5 is 17.6 percent lower than the historic average of 49.2.

Optimism among investors edged up 0.4 percent from 46.3 in May to 46.5 in June, while it slumped by 6.0 percent among non-investors, from 40.1 in May to 37.7 in June.

Read MoreEconomist: ‘True’ Federal Debt Masked by Draining U.S. Treasury

The federal debt continues to climb to unprecedented levels, but the “actual, true” debt is higher if the Treasury weren’t being drained, a national economist says.

Citing Bureau of the Fiscal Service data, E. J. Antoni, Ph.D., an economist at the Heritage Foundation, argues that as the federal debt increases, the “true daily deficit” is being masked by the amount of cash being drained from the U.S. Treasury by Treasury Department Secretary Janet Yellen.

Read MoreFeds Borrowed $6 Billion Per Day So Far This Fiscal Year

The U.S. federal government has borrowed about $6 billion per day so far this fiscal year with little indication of slowing down.

The U.S. Treasury Department released its figures for the month of March showing it borrowed $236 billion in March alone, bringing the total to $1.1 trillion for this fiscal year, which runs from October to September.

Read MoreWatchdog: Biden’s 2025 Budget Would Drive National Debt to $45 Trillion in 10 Years, 106 Percent of GDP

The Committee for a Responsible Federal Budget (CRFB) a budget watchdog group, found that President Joe Biden’s fiscal year 2025 budget would drive the national debt to $45.1 trillion or 106 percent of the U.S. Gross Domestic Product (GDP) by 2034, from $27.4 trillion or about 97 percent of GDP at the present time.

The organization noted that those calculations are based on the Biden administration’s own internal figures. The current $27.4 trillion debt figure is the debt held by the public, not the total national debt including intragovernmental holdings.

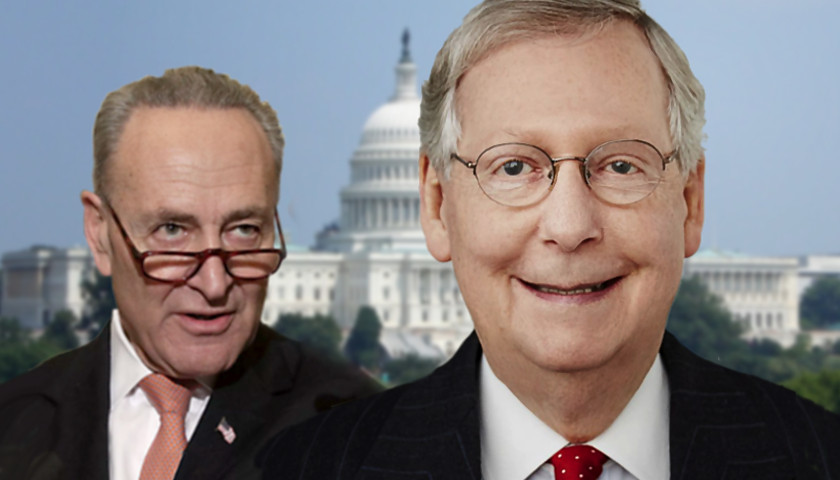

Read MoreMitch McConnell’s Legacy: $27.6 Trillion in National Debt

Senate Minority Leader Mitch McConnell on Wednesday announced plans to step down as GOP conference leader in November, marking an end to his more than 20-year stint in Senate leadership that saw the U.S. accumulate a mountain of debt.

“One of life’s most underappreciated talents is to know when it’s time to move on to life’s next chapter,” he said on the Senate floor. “So I stand before you today … to say that this will be my last term as Republican leader of the Senate. I’m not going anywhere anytime soon. However, I’ll complete my job. My colleagues have given me until we select a new leader in November and they take the helm next January.”

Read MoreCommentary: Seven Ridiculous Examples of Government Waste in 2023

Almost nobody doubts that the federal government wastes a lot of money. Every day we hear stories of fraud, mismanagement, and misplaced priorities that cost taxpayers millions, and sometimes billions, of dollars.

But just how much money is wasted? In his annual Festivus report—named after the fictional Seinfeld holiday—Senator Rand Paul tallies up some of the most egregious examples of government waste from the year. The report for 2023 came out on December 22, and as usual, the stories spanned the range from hilarious to deeply disconcerting. In all, Paul identified $900 billion in government waste from 2023.

Read MorePoll Finds Americans Worried About National Debt

Americans are worried about the national debt, according to the results of a new poll.

Americans have the national debt crisis as one of their top concerns along with war, inflation and crime. Those polled think the overspending has a direct impact on their personal security and also has an impact on the security of the United States, according to a recent study commissioned by Main Street Economics, a nonprofit group designed to educate Americans on the nation’s debt crisis.

Read MoreMeet the Leaders in Congress Who Helped Amass a Staggering $34 Trillion in National Debt

The national debt continues to rise sharply to record levels during the ongoing debate in Congress over the next federal spending bill.

The federal government has already piled another $383 billion onto the debt so far into the 2024 fiscal year, which began on October 1.

Read MoreKentucky U.S. Rep. Thomas Massie Says It Is ‘Economically Illiterate and Morally Deficient’ to Send More Money to Ukraine on Episode 45 of ‘Tucker on X’

In episode 45 of his newest production, “Tucker on X,” host Tucker Carlson interviewed U.S. Representative Thomas Massie (R-KY-04) who is against sending more aid money to Ukraine in the country’s fight against Russia.

Read MoreGross National Debt Hits $32 Trillion for First Time in U.S. History

The gross national debt reached $32 trillion for first time in U.S. history on Friday.

The Congressional Budget Office estimates that the nation’s deficit for fiscal year 2023 will be $1.4 trillion, driving the national debt even higher.

Read MoreTea Party Patriots Action Condemn House Speaker McCarthy for Debt Ceiling Deal, Urge Republicans to Vote in Opposition

Tea Party Patriots Action (TPPA), the national conservative nonprofit group founded at the height of the Tea Party Movement, is condemning House Speaker Kevin McCarthy (R-CA-20) for negotiating an increase of $4 trillion to the national debt over the next 18 months and calling on House Republicans to vote against the bill.

Read MoreCommentary: Biden’s 10-Year Plan for Fiscal Disaster

Last month, President Joe Biden unveiled his proposed 10-year budget plan. The dollar figures are eye-popping: $17 trillion dollars in additional debt.

The previous 10-year period, 2013 through 2022, saw the national debt rise by an unprecedented $14 trillion, an amount that was turbo-boosted by the over-the-top COVID spending blowout. Yet, instead of a return to the bad-enough normalcy of an annual debt increase measured in the hundreds of billions rather than trillions, Biden wants to set a new record for debt accumulated in a decade, with an average annual deficit of $1.7 trillion being his “new normal.”

Read MoreCommentary: ‘Economist’ Krugman’s Accounting of the National Debt is Jailworthy

The national debt has risen at a blistering pace over recent decades and is now higher than any era of the nation’s history—even when adjusted for inflation, population growth, and economic growth (GDP).

Denying this reality, Nobel Prize-winning economist Paul Krugman recently wrote two columns for the New York Times in which he claimed that the debt is an “overhyped issue” and “isn’t all that unusual” from a historical perspective. His attempts to support these assertions employ the kind of fraudulent accounting that could land a corporate executive in jail.

Read MoreU.S. Projected to Tack on $19 Trillion in Debt over Next Decade as Spending Soars

The U.S. is likely to add $19 trillion more to the national debt in the next 10 years, which is $3 trillion higher than previously expected, new Congressional Budget Office (CBO) predictions show.

By the end of 2023, the CBO projects the deficit to be $1.4 trillion, and it will continue to average about $2 trillion annually, raising the debt to about $52 trillion. The CBO report indicates that the rise in the deficit is a result of bipartisan legislation coupled with the Federal Reserve’s hike in interest rates.

Read MoreCommentary: A Blueprint for Tackling America’s Crippling National Debt

Our debt is too large. Inflation is too high. We rarely pass a budget anymore — this year neither Budget Committee even bothered to come up with one. This is how great nations become weakened nations, and with all the threats on the world stage, it is urgent we make a change now.

What we need is a budget that changes our fiscal trajectory away from one where the debt is growing faster than the economy, to one where it is stabilized and then gradually brought down.

Read MoreCommentary: The Left Were the Mad Scientists, Americans Were Their Lab Rats

As the midterms approach, one way of looking at America’s current disaster is that we, the American people, were lab rats. And since 2021, the Left were the mad scientists, eager to try out their crackpot leftist experiments on us.

The result is that the housing market is tottering on the verge of collapse.

Read MoreCommentary: The Ungracious—and Their Demonization of the Past

The last two years have seen an unprecedented escalation in a decades-long war on the American past.

But there are lots of logical flaws in attacking prior generations in U.S. history.

Read MoreManchin Condemns Schumer’s GOP Bash After Parties Compromise on Debt Limit, Says ‘Civility Is Gone’

West Virginia Sen. Joe Manchin was once again at odd with his party Thursday evening, as fellow Democrat and Senate Majority Leader Chuck Schumer laid into his GOP colleagues during a floor speech following a vote to approve legislation that would temporarily raise the debt ceiling.

“Republicans played a dangerous and risky partisan game, and I am glad that their brinksmanship did not work,” said Schumer, beginning a series of remarks that would target his colleagues across the aisle, including 11 of whom voted to end debate on the debt ceiling measure, allowing for the full vote to happen.

Manchin, who could be seen seated direct behind Schumer, as the New York lawmaker made his remarks, appeared at first to be shaking his head disapprovingly before placing his head in his hands.

Read MoreCritics Pan Biden’s Claim $3.5 Trillion Spending Bill Costs ‘Zero’

President Joe Biden is taking fire for comments he made about his $3.5 trillion legislation just as the bill faces a deeply split Congress.

Biden made headlines for claiming the bill would cost “zero dollars,” despite media reports and members of both parties commonly naming the bill’s cost at $3.5 trillion for the last several months.

Read MoreYellen: U.S. Will Be out of Money in October If Congress Doesn’t Raise Debt Ceiling

Treasury Secretary Janet Yellen warned congressional leaders Wednesday that the U.S. is on track to default on its debt sometime in October if Congress fails to raise the debt ceiling.

Yellen said the Treasury would likely run out of cash in the coming weeks and exhaust its “extraordinary” spending measures to keep the country within its legal borrowing limit.

Read MoreCommentary: Inflation Hits 5.3 Percent in July as $1.2 Trillion Infrastructure Bill Easily Passes with $3.5 Trillion Stimulus Expected in September

The unadjusted consumer price index as measured by the Bureau of Labor Statistics was 5.28 percent for the month of July, slightly lower than June at 5.32 percent, but still measuring the highest inflation on record since July 2008, when it hit nearly 5.5 percent.

The latest numbers come as Congress has easily passed another gargantuan $1.2 trillion infrastructure spending plan that included $550 billion of new spending. Interest rates have already reacted as 10-year treasuries came off a near-term low of 1.17 percent on Aug. 2 to 1.36 percent as of Aug. 12, slightly increasing inflation expectations.

The $1.2 trillion spendathon was just the latest in a long line of spending that has added $5.25 trillion to the national debt since Jan. 2020 in response to the Covid pandemic all the way to the current $28.5 trillion: the $2.2 trillion CARES Act and the $900 billion phase four under former President Donald Trump, and then the $1.9 trillion stimulus under President Joe Biden. It’s been a bipartisan affair.

Read MoreU.S. Set to Hit Debt Ceiling Within Four Months, Congressional Budget Office Estimates

The federal government is on track to reach the statutory debt limit in the fall, which would trigger a government shutdown, according to a Congressional Budget Office (CBO) estimate.

The U.S. is projected to reach the debt ceiling of $28.5 trillion by October or November, a CBO report released Wednesday stated. If Capitol Hill lawmakers don’t reach an agreement on raising the limit higher, the government could undergo its third shutdown in less than four years.

“If the debt limit remained unchanged, the ability to borrow using those measures would ultimately be exhausted, and the Treasury would probably run out of cash sometime in the first quarter of the next fiscal year (which begins on October 1, 2021), most likely in October or November,” the CBO report said.

Read MoreStacey Abrams Purchased Two Homes Valued at $1.4 Million After Reporting Massive Debts in 2018

Former Georgia Democratic gubernatorial candidate Stacey Abrams purchased two homes worth a combined $1.4 million following her failed 2018 bid to lead the state, public records reviewed by the Daily Caller News Foundation show.

Abrams purchased the homes despite reporting in a financial disclosure in early 2018 during her gubernatorial campaign that she owed the IRS $54,000 in back taxes on top of $174,000 in credit card and student loan debt.

Abrams purchased a 3,300 square foot home in Stone Mountain, Georgia, for $370,000 in September 2019, according to Nexis real estate records. The home is now worth $425,000, according to Redfin.

Read MoreAnalysis: Deficit Will Top $3.6 Trillion in Fiscal Year 2021 as $7.27 Trillion of the National Debt Comes Due in the 2022

The annual budget deficit has already hit $1.9 trillion and counting for the fiscal year that will end in September, according to the U.S. Treasury’s April statement, and it will reach as high as $3.6 trillion this year, says the White House Office of Management and Budget (OMB). Comparatively, in 2020, the deficit totaled about $3.1 trillion for the entire year.

This comes amid the massive government spending in response to the Covid pandemic, including the $2.2 trillion CARES Act in March 2020, the $900 billion phase four legislation in Dec. 2020 and then President Joe Biden’s additional $1.9 trillion Covid stimulus bill in March 2020. Another $2.1 trillion infrastructure plan is in the works. And now, Biden is offering his $6 trillion budget, which will blow another $1.8 trillion hole in the deficit in 2022.

As a result, 33 percent of marketable national debt, or about $7.27 trillion of the $22 trillion of publicly held debt, will be coming due within the next year, according to the latest data by the U.S. Treasury. For perspective, that’s more debt than existed as recently as 2003.

Read MoreReport: U.S. National Debt Closer to $123 Trillion, Nearly $796,000 Per Household

The U.S. national debt is closer to $123 trillion, more than four times what the Treasury Department is reporting, Chicago-based Truth in Accounting calculates in its new annual analysis of the nation’s finances.

The federal government has $5.95 trillion in assets and $129.06 trillion worth of bills resulting in a $123.11 trillion shortfall, or a debt burden of $796,000 per U.S. household.

Because of this massive amount of debt and repeatedly poor financial decisions made by lawmakers, TIA gave the U.S. government an “F” grade for its financial condition.

Read MoreCongressional Budget Office Projects Record Deficits over the Next Decade

Federal deficits are projected to skyrocket over the next decade, resulting in a national debt that could be 107% of U.S. GDP, according to a recent Congressional Budget Office report.

The United States’ debt reached 100% of GDP during the past fiscal year largely due to the federal response to the coronavirus pandemic and the $2.2 trillion CARES Act passed in March 2020. While the CBO’s February report projects unprecedented deficits, they are smaller than the office’s projections from last summer due to the country’s promising economic outlook.

Read MoreThe U.S. National Debt Has Exceeded the Total Value of the GDP

The U.S. national debt now exceeds the size of America’s total gross domestic product and the milestone may have been met as early as June, according to a Friday New York Times report.

America’s federal debt stands at around $26.6 trillion — an approximate $7 trillion increase since 2016, according to fiscal data from the Treasury Department. Total U.S. gross domestic product (GDP) was just over $19.4 trillion at the end of June, according to a July 30 release from the U.S. Bureau of Economic Analysis.

Read MoreAnalysis: National Debt Breaks Record for Highest Portion of U.S. Economy in Nation’s History

The U.S. national debt has just reached 120.5% of the nation’s annual economic output, breaking a record set in 1946 for the highest debt level in the history of the United States. The previous extreme of 118.4% stemmed from World War II, the deadliest and most widespread conflict in world history.

Today’s unprecedented debt-to-economy ratio—which is economists’ primary measure of government debt—includes $2.5 trillion in new debt since the outset of the Covid-19 pandemic. However, it doesn’t account for the vast bulk of economic damage inflicted by government-mandated business shutdowns, which will soon make the debt ratio significantly larger by decreasing its denominator. Although this decline has already begun, most of it is not yet reflected in the official data on the size of the U.S. economy.

Read More