RICHMOND, Virginia – The House of Delegates and the Senate have passed their separate budget proposals for Fiscal Year 2022 and 2023. Both chambers debated floor amendments to the bills on Thursday before passing them, but the final versions are broadly similar to the proposals announced earlier this week. Each chamber’s proposal is based on former Governor Ralph Northam’s budget proposal, but the money committees made significant amendments before sending them to be passed out of the House and Senate. The Senate bill contains fewer tax cuts than the House bill, allowing for more spending, while the House bill is closer to the tax policy Governor Glenn Youngkin has called for. The two chambers now enter a process of working to a compromise.

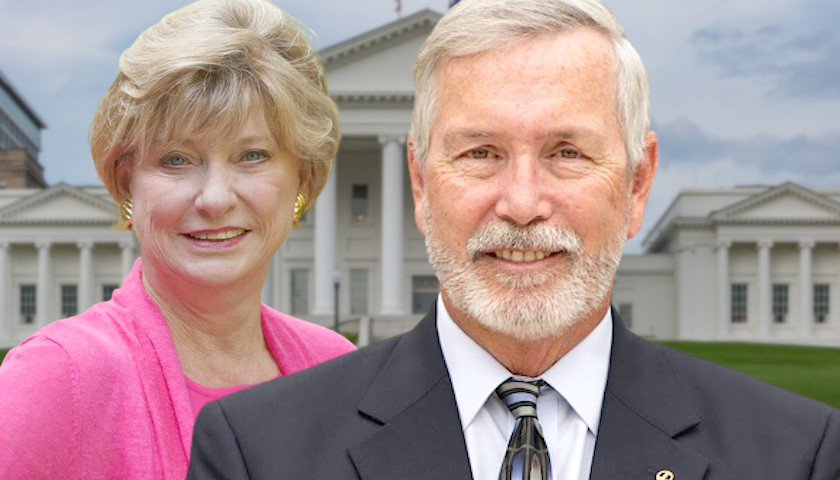

Senate Finance Chair Janet Howell (D-Fairfax) told the Senate that the proposal fulfilled promises made amid spending cuts during earlier hard times.

“In this budget we’ve done that, by making significant investments in education, natural resources, public safety, and human services. We’re also chipping away a funding cap on support positions for K-12 education over both years of the biennium, embracing increased teacher and state employee pay, and adding to those compensation increases a one-time bonuses for teachers and state employees,” Howell said.

Read More